Rabobank Outlook 2016: Bearish Grains, Stable for Cattle

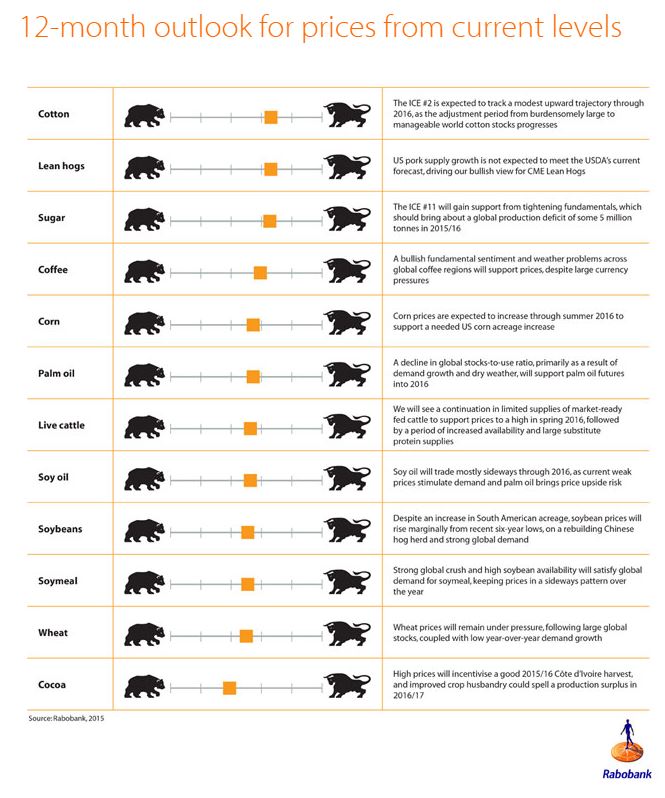

ANALYSIS - Agri commodity stocks remain comfortable and are expected to limit price gains to modest levels throughout 2016 for grains and oilseeds, while hogs, sugar and coffee prices are expected to head higher. Cattle prices are expected to remain fairly stable, report Rabobank analysts.

While weather problems paint a bright price outlook for coffee and sugar, grains and oilseeds are likely to be more stable prospects. Record production of grains and oilseeds from South America coupled with decent crops elsewhere materialised in very high global stock levels, which weigh on prices and limit volatility.

The dollar strength, which we expect to continue through 2016, will generate stock building of grains and oilseeds in the US, while currency weakness in emerging countries like Brazil, Ukraine and Russia, will see very aggressive commodity export offerings from these countries.

Stefan Vogel, Global head of Rabobank (pictured) said: "Despite large stocks in the G&O complex and currency pressure from a strong US dollar, we still see more upside than downside risks due to likely weather events across commodities."

From the consumer side, processors can benefit from rather attractive prices in USD terms and also fairly flat future curves in grains, oilseeds and sugar.

The weather will potentially be a key driver in commodity markets. The current El Niño, one of the strongest on record, is expected to affect sugar, cocoa, palm oil and Robusta coffee crops. El Niño is expected to gradually weaken in Q1 2016 but its effects will continue to affect commodity prices. The winter weather in Russia, Ukraine and the US will also be a key driver for grains and oilseeds, even in the absence of a direct El Niño link.

Grains are expected to continue to trade around current levels, as weather related risks are counterbalanced by currency weakness, in many key producing countries, whereas Rabobank expects some upside on coffee, sugar and cotton.

TheCattleSite News Desk