Signal shares grains market performance

Signal takes a deeper dive into the corn market

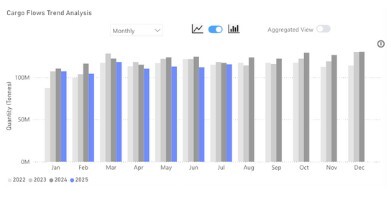

The overall grains market performed well through July, with overall tonnage up on both a m/m and a y/y measure, 10% and 3% respectively. Despite this, the YTD figure for total grain exports to the end of July trails the same period in 2024 by almost 6%. In this edition of the Major Bulk Radar, Signal Ocean has taken a more detailed look at the corn market.

The corn market presented some interesting moves during July, with striking differences between performance based on a monthly or annual comparison. According to Signal Ocean, global corn exports increased 31% m/m and 1% y/y, driven by a huge surge in shipments from Brazil, which more than compensated for a 12% m/m drop in shipments from the U.S. Yet, U.S. corn shipments increased by 8% y/y while Brazilian shipments decreased by 15%.

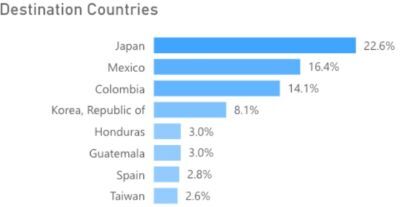

There were also more interesting developments in terms of shipment destinations. From 2022 to now, 10% of all corn shipments have been shipped to China; however, this figure drops to below 4% if we look at all corn shipments since 2024. In July 2025, only 3% of corn shipments were shipped to China.

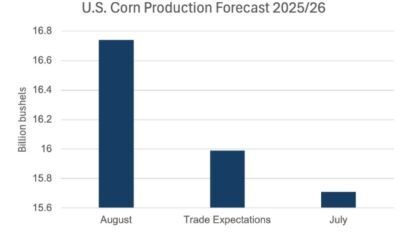

China has been importing less corn since 2024 as the nation produces more domestically. The China Agriculture Outlook Committee has forecast corn production in the 2025/26 year to be 3% higher than the 5-year average, while domestic growth slows and drags on demand, both factors weighing on the need for imports. However, the U.S. and Brazil are both set for bumper corn harvests in 2025/26. The USDA August report raises the U.S. corn production forecast to 425.3mt, up 7% from the July forecast, and Brazilian production is set to reach 131mt in the same period, the third highest yield on record. In theory, this should be positive for corn shipments, as ample production should lead to greater availability for export.

However, there are a number of factors that may limit the upside. Brazil is planning to use more corn for the production of ethanol. Historically, around 90% of ethanol production in Brazil came from sugar-cane, but given the lower cost and higher abundance, the use of corn in ethanol production is rising rapidly. Petrobras has recently announced it will be ‘leaning towards corn’ for its foray back into ethanol production. As a result, the increase in corn production will not transfer directly into more corn for export, and exports could fall back if ethanol production becomes a higher value proposition. In this instance, ethanol exports from Brazil would increase while corn exports remain stable or soften.

The U.S., however, already diverts around 40% of corn production into ethanol, and with a higher corn crop this year, there still remains a large surplus of corn to export. The increased supply of corn will likely weigh on corn prices, with the December 2025 futures contract already the lowest it has been in five years. This will make U.S. corn more attractive for importers, and particularly the large Asian or Central American buyer like Japan or Mexico. China has been diverting from U.S. agricultural products in recent years, but if prices are low enough, China would likely take advantage and use it as a way to stocks full and secure. There is a 7.2mt quota on imported corn in China, with imports over that facing a much higher tariff. Corn prices would need to be low enough to make importing still financially viable if the quota were reached.