Russia Dairy And Products Semi Annual 2011

Inventories of cows in milk will decrease slightly but continued improvements in productivity and increased feed availability should increase fluid milk production by 1.5 per cent in 2012, according to this latest GAIN report from the USDA Foreign Agricultural Service.Russian milk production is forecast to rebound 1.5 per cent in 2012 as feed supplies begin to replenish in the second half of 2011. In turn, as milk prices return to lower levels, local processors will direct more milk toward butter production. In 2011, butter production is revised downward, reflecting production to date. While Belarus remains the dominant as well as the GOR's preferred supplier of foreign dairy products, imports from all major suppliers have increased significantly in 2011 with rising retail prices.

Russian production and trade-related policies will remain moving targets throughout the remainder of 2011 and likely into 2012 as the GOR continues to develop common regulations with its Customs Union partners as well as attempts to rebalance Russia's competitiveness in the market.

Fluid Milk

Share of factory use consumption in total 2012 fluid milk production will grow to 56 per cent from 55 per cent in 2011 with the aid of subsidies to modernise Russian dairy processors. Modern agricultural enterprises, which represent a growing percentage of milk production, sell 98 per cent of their milk for processing. Estimates in 2010 and 2011 reflect production and trade through March 2011.

Butter

Butter production is forecast to grow 7.7 per cent in 2012, fully displacing imports and reflecting increased State support and lower expected milk prices as feed supplies replenish. Consumption is forecast flat as dairy spreads increase in popularity among consumers as a butter substitute. The Ministry of Agriculture's Target Program “Development of butter and cheese production in Russia for the period of 2011–2013” (Dairy Products Program) envisages 3.8 per cent butter production in 2011, 3.3 per cent in 2012, and 3.7 per cent in 2013. However, market conditions resulting from the 2010 drought negatively influenced implementation of the programme in 2011. Estimates in 2010 and 2011 reflect production and trade through March 2011.

Cheese

Cheese production and imports are forecast to grow 2.3 per cent in 2012, reflecting increased State support and lower expected milk prices as feed supplies replenish. The Dairy Products Program envisages 4.5 per cent more cheese production in 2011, 4.8 per cent in 2012 and 5.2 per cent in 2013. Like butter, the 2010 drought negatively influenced implementation of the program in 2011. Estimates in 2010 and 2011 reflect production and trade through March 2011.

Non-Fat Dry Milk (NFDM)

NFDM production is forecast to increase 7.1 per cent to 75,000 MT in 2012. The Dairy Products Program envisions increased marketing of raw material byproducts of dairy processing, which should support production of NFDM. Estimates in 2010 and 2011 reflect production and trade through March 2011.

Whole Milk Powder

Whole milk powder production is forecast to increase 5.0 per cent to 63,000 MT in 2012 based on market analysts? expectations. Estimates in 2010 and 2011 reflect production and trade through March 2011.

Production

Cow Inventory

By the beginning of 2012, cow inventories will shrink by 2.0 per cent as feed costs will remain problematic through at least the 2011 harvest. By the end of March 2011, cow inventories decreased 1.6 per cent compared to 2011 to 8.9 million head after cattle slaughter rates increased in 2010 as a result of the drought which sharply decreased feed supplies. Feed availability per cow-equivalent unit was 30 per cent lower by the end of March 2011 compared to the same period of 2010. Dairy cow stocks fell 2.8 per cent in 2010.

Fluid Milk

Continued improvements in productivity as well as increased feed availability should increase fluid milk production by 1.5 per cent in 2012. In 2011, feed shortages led to a decline in milk production of 2.2 per cent which is forecast to decrease to 31,200 MMT in 2011.

Russia continues to improve milk productivity at agricultural enterprises to replace declining herds. Of the 31.9 MMT of fluid milk produced in Russia in 2010, agricultural enterprises accounted for 44.9 per cent, private households accounted for 50.4 per cent, and private farms accounted for 4.7 per cent of production. In 2009, these figures were 44.5 per cent, 51.1 per cent, and 4.4 per cent, respectfully. In 2011, agricultural enterprises decreased first quarter fluid milk production to 6.2 MMT or 2.3 per cent the same period in 2010. At the same time, annual cow milk productivity at these establishments increased to 1,108 kg from 1,093 kg.

Poor management and the failure of most farms to modernize continue to hurt advancement of the Russian dairy industry. According to press reports, many leaders and top specialists simply do not know basic technological processes or market regulations. Prior to higher milk prices, many agricultural enterprises, equipped with new infrastructure and technology (supported by federal and regional budgets), were returning large profits. However, even during this period, since support was not reaching all Russian businesses, both producers and processors with older technologies were arguing that the dairy industry was unprofitable. In an attempt to resolve the inequity, the Russian Union of Milk Producers (SoyuzMoloko) and the Russian State Agricultural Leasing Company (RosAgroLeasing) signed a cooperation agreement with the target of providing equal access to federal credit to farmers for purchases of agricultural equipment and breeding animals. The main objectives of the agreement are as follows:

- the implementation of measures to support domestic farmers

- the development of domestic livestock breeding, and

- an increase of agricultural production by small producers in the rural areas by creating an environment for dairy processing, storage and marketing.

The two organisations also discussed creating agricultural education and production centres for meat and dairy specialists to learn modern production methods.

Fluid Milk Prices

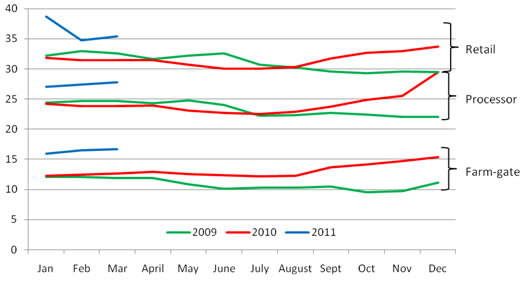

The reduced milk supply continues to support prices in all segments of the market: farm-gate, processor and retail well above year-ago levels (Chart 1).

Currently, with high milk prices, the financial position of dairy processors has become more difficult. Dairy product stocks are high, but due to high prices which have made imports competitive, quantity-demand for domestic products is low. As a result, the largest dairies have begun to decrease purchase prices for raw milk. They note that the price for raw milk should be between RUR11-14 per litre (US$0.37-$0.48) for 3.0-3.4 per cent fat milk in 2011.

SoyuzMoloko reports that farms that took credits and modernized their production now struggle to pay back credit as demand for their products and profits have decreased. While some dairies are providing their fluid milk suppliers with credit, SoyuzMoloko insists that the State should forgive at least a portion of the debt and continue to subsidize loan interest rates, since it has an obligation to ensure the profitability of dairy producers.

(3.2 per cent fat, RUR/kg)

Dairy Products

Lower priced milk that will come with increased supply in 2012 will primarily benefit domestic butter production, while other dairy products will see comparatively modest gains. The Ministry of Agriculture's Target Program “Development of butter and cheese production in Russia for the period of 2011–2013” (Dairy Products Program) should support the modernisation of Russian dairy processors and thereby also support increased milk volume destined for factory use. Specifically, the plan foresees that 15-16 per cent of fluid milk sent to the processing industry will go for cheese production. Domestic production of milk powder remains important to account for seasonal milk production in addition to retaining strategic stocks.

The Russian State Statistics Service (Rosstat) January-March data indicates a more a favourable outlook for cheese and WMP than previously forecast but a more pessimistic outlook for butter and NFDM. Production-to-date of whole milk products (calculated as milk-equivalent) and butter decreased by 1.9 per cent and 6.3 per cent, respectively. Butter production remains severely constrained by high milk prices and increased consumer preferences for lower priced dairy spreads. According to SoyuzMoloko, dairy spread production was 11.5 per cent higher than butter production during the fourth quarter of 2010 – a first in Russian history.

Estimates in 2010 reflect final 2010 Rosstat data. Fluid milk, cheese, and whole milk powder production volumes increased, while butter production decreased.

Modern agricultural enterprises, which represent a growing percentage of milk production, sell 98 per cent of their milk for processing.

Milk and Dairy Product Marketing

Growing Interest in Milk Marketing CooperativesRussia has seen an emerging interest in dairy cooperatives in order to increase profits. In an average size dairy oblast, Lipetsk, 60 per cent of the milk producers organised a milk marketing cooperative in order to allow farmers to concentrate on production. As a result, cow inventories of cooperative members have already grown, and the cooperative has fixed a year-long milk price with its major customers. These dairy farmers are now demanding the GOR decrease VAT for milk sold from dairy cooperatives. Also, they are actively campaigning for the GOR to turn to dairy cooperatives when purchasing milk for social needs, e.g. schools, hospitals, army and prisons.

Trading Dairy Products on the ExchangeIn March, SoyuzMoloko and Moscow Interbank Currency Exchange (MICEX) signed an agreement of cooperation, which includes plans for spot trading, deliverable futures contracts, as well as settlement services for milk and dairy products. Spot trading of dry milk should begin sometime during the second quarter of this year. Contracts for other dairy commodities, including butter, will follow. Russian, Belarusian, Kazakh and Ukrainian parties are expected to trade on the market.

Trade

Imports

While butter imports should fall back in 2012 as domestic production increases, increasing consumer buying power should continue to support cheese imports. Market analysts expect both WMP and NFDM imports will increase slightly. In 2011, the short milk supply has increased year-to-date imports of butter, cheese and fluid milk. However, while imports of milk powder from third-party suppliers are above last year levels, lower imports from Belarus have kept total import supply relatively flat.

In spite of prolonged shortages, Russia continues to restrict market access for dairy products actively through the use of quantitative measures as well as sanitary and technical barriers to trade. The aim is two-fold:

- restrict foreign supply in order to support domestic prices and thereby, support domestic production, and

- where imports are necessary, import from Russia's Custom Union partners, particularly Belarus.

Tariffs and Quotas

Lobbied by a strong domestic dairy industry, the Russian Ministry of Agriculture is considering further increases to customs duties on dairy products. In 2010, import duties increased on cheese, whey, other dairy products, as well as palm oil. The Russian-Kazakh-Belarusian Customs Union (CU) must approve any decision to increase duties.

Annually, Belarus supplies roughly 40 per cent of Russia's imported butter, 30 per cent of its cheese, 80 per cent of its milk powder and 85 per cent of its fluid milk. Nonetheless, imports from Belarus are currently limited though a quota system with quarterly targets. However, Belarus and Russia maintain an understanding that the quota levels can be changed in order to meet Russian market conditions.

SPS/TBT

Market access for countries outside the CU will further come into question in 2012. According to CU Decision 455 of 18 November 2010, Russia will cease honouring all previously agreed dairy health certificates on 1 January 2012. From that date, CU Decision 607 of 7 April 2011 sets forth the new uniform health certificates, which Russia will force exporters to use.

Currently, Russia does not permit the United States to export dairy products to Russia. Russia maintains that in order to export, dairy products must come from CU-approved facilities. Russia began enforcing this requirement in September 2010.

Exports

Russian dairy exports are negligible and destined primarily to former Soviet Union countries.

Further Reading

| - | You can view the full report by clicking here. |

June 2011