New Zealand Dairy and Products Semi-Annual Report 2008

By USDA, Foreign Agricultural Service - This article provides the dairy industry data from the USDA FAS Dairy and Products Semi Annual 2008 report for the Voluntary Semi Annual Report from New Zealand. A link to the full report is also provided. The full report includes all the tabular data which we have omitted from this article.Report Highlights

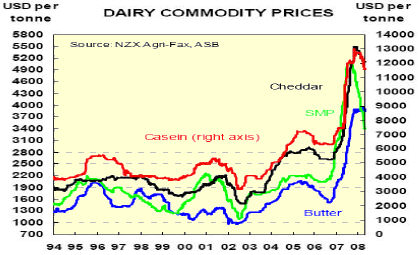

The worldwide supply and demand situation for dairy products has translated into a record farm gate price of NZ $7.30/kg (USD 5.62) of milk solids being paid to New Zealand dairy farmers for MY 2007/08. While next year’s farm gate price will likely be lower, it is still expected to be the second highest payout on record. While the record high payout should have resulted in a jump in production, New Zealand dairy production is forecast to slump 4.6% in MY 2007/08. The main reason for the decline is the drought that covered much of New Zealand during January through April 2008. Skim milk powder and butter exports are expected to fall significantly in MY 2007/08 while whole milk powder export volumes are expected to remain constant. Cheese exports are forecast drop approximately 3% from MY 2006/07 levels.

Executive Summary

Prospects for the New Zealand dairy industry in the near term are positive. The worldwide supply and demand situation has translated into a record farm gate price of NZ $7.30/kg (USD 5.62) of milk solids being paid to New Zealand dairy farmers for MY 2007/08. While next year’s farm gate price will likely be lower, it is still expected to be the second highest payout on record. With the relative profitability of dairy production vis a vis sheep and beef production, conversions of land to dairying are continuing as fast as infrastructure will allow.

While the record high payout should have resulted in a jump in production, New Zealand dairy production is forecast to slump 4.6% in MY 2007/08. The main reason for the decline is the drought conditions that covered much of New Zealand during the January through April, 2008 time period.

With the drop in domestic milk supply, it has been a challenge for exporters to maintain export volumes. Skim milk powder and butter exports are forecast to record significant decreases in volume for MY 2007/08. Of the main commodity groups, only whole milk powder (WMP) is expected to record export volumes the same as last year. However, cheese exports are forecast to drop only 3% from MY 2006/07 levels. This reflects the relatively profitability to New Zealand dairy processors for WMP and cheese. In the short to medium term, it is likely that cheese exports will increase slightly faster than the increase in overall milk supply.

Over the long term, there are many factors within New Zealand that are likely to constrain the rate of increase in the milk supply and ultimately the size of the industry. Environmental concerns are impacting on dairy farming with local, regional, and national government compliance costs increasing faster than the rate of inflation. There is an increasing focus on nitrate and phosphate pollution of the waterways and there will be increased compliance costs in this area to the point of production being limited in certain areas. Because of the nation-wide shortage of labor, wage costs have risen significantly and are expected to continue increasing. While overall there is sufficient quantity of water in New Zealand, getting it water to the right place at the right time is becoming increasingly expensive both in terms of infrastructure costs and environmental planning.

Parts of the Dairy Industry Restructuring Act (DIRA) are to be overhauled this year. The main thrust of this review is the development of a new mechanism to price milk that Fonterra is obligated to supply to alternative processors. New milk processing factories are being built or are in the planning stage, which, according to the Ministry of Agriculture and Forestry, means that Fonterra’s market share could drop from approximately 95% to between 85 and 90% by 2013.

Production, Consumption, Trade and Policy Production

MY 2007/2008 Drought Conditions Temper Production

Fairly severe drought conditions over most of the North Island and part of the South Island resulted in reduced milk production. Post has adjusted its production estimate downward and now forecasts that New Zealand dairy production will fall 4.6% in MY 2007/08. The drought conditions covered much of the country from January through April of 2008, including the Waikato region, which is the main dairy producing region in New Zealand. Two regions - the west coast of the South Island and the dairying areas north of Auckland on the North Island - were largely spared from the drought. Westland Cooperative, which is located on the west coast of the South Island, is reporting increased milk production over last year.

Fonterra’s Farm Gate Milk Price Reaches Record Level

Fonterra, a farmer cooperative and the largest milk processor in New Zealand with a 95% share of domestic milk production, announced in April 2008 that it will pay out NZD 7.30/kg (US $5.62) of milk solids (MS) for MY 2007/08. This is the highest price ever paid out to New Zealand dairy farmers and is a direct result of the run up in world dairy prices. The record high prices are moderated somewhat by the high New Zealand dollar, which has appreciated significantly against the U.S. dollar.

Production Expected to Increase in MY 2008/2009 and Beyond

The effects of the drought will still be felt going into the next season, largely because of the relatively poor condition of cows going into the winter season and relatively low pasture supplies on farm. There is significant demand for supplementary feed and off-farm grazing, which is driving up the prices for hay, silage and feed grains. It is likely that the effects of the drought will moderate the recovery in production expected next year when additional farm conversions will come on stream together with increased numbers of cows.

Post forecasts a significant upturn in production in the MY2008/2009 year, with domestic milk production expected to reach 16 to 16.5 million tons of milk, up from an estimated 14.9 million tons in MY 2007/08, and 15.6 million tons in MY 2006/07. The increase is largely attributable to the increase in both the number of dairy cows and dairy area going into the MY2007/2008 season.

The ongoing conversions of sheep and beef land to dairying, combined with deforestation of land for dairying, is expected to result in approximately 150 new farms coming on stream per year for the next two to three years. As such, it is expected that milk supply will increase between 2.5 to 4% per annum for the next three to four years.

Environmental Concerns Over Dairying Continue to Grow

There are several factors that will influence the level of dairy production in New Zealand in the future. One issue receiving significant attention is the environmental impact of dairy production. While only 7% of New Zealand’s total land area is occupied by dairy farms, there is concern that the increasing intensity of dairy farming (e.g. a steady increase in the stocking rate and production per hectare) is causing a buildup of nitrates in the soil, which are leaching into the waterways and potentially harming water quality. In addition, there is some evidence that soil quality is being adversely affected with the loss of organic matter, compaction, and loss of micro flora and fauna.

New Zealand dairy farmers must comply with environmental regulations promulgated and administered by Regional Councils under the auspices of the Resource Management Act. While Council requirements vary by region, compliance costs associated with meeting the requirements have steadily increased over the past several years. Under Fonterra’s Clean Streams Accord, farmers are required to fence off waterways and carry out nutrient budgets.

Many industry observers believe that the growing compliance costs associated with environmental regulations will diminish profitability and temper how much the New Zealand dairy industry can expand. The Waikato region on the North Island accounts for approximately 50% of dairy production in New Zealand. With the advent of the conversion of pine forests to dairying, it has been estimated by Environment Waikato that, in order to achieve no further deterioration of water quality by 2030, nitrogen leaching from all dairy farm land would need to be capped at 26 kg/ha (based on assumptions of around 60,000 ha being deforested and converted to dairying). At present, the only definitive way for dairy farms to achieve this target would be to: apply no nitrogen fertilizer, which would reduce stocking rates; or spread all of their dairy shed effluent over the farm. It is estimated that meeting this requirement would result in a reduction in gross financial margin of 9 to 10%.

New Zealand’s Cost of Production is Increasing

While dairy farmers are celebrating the fact that they are receiving NZ$7.30/kg (USD5.62) of milk solids, on farm and debt servicing costs have escalated this year. Well-managed, largescale dairy conversions in the Canterbury region of the South Island have seen their costs increase from NZ$2.75/kg (USD 2.12) of milk solids to NZ$3.50/kg (USD 2.70) of milk solids this year, and there is speculation that costs could escalate to NZ$3.75/kg (USD 2.89) of milk solids next year.

The table below, which is based on Dairy New Zealand estimates for the current season, shows the estimated financial figures for an average dairy farm producing 100,000 kilograms of milk solids per year. The magnitude of the increase in farm operating costs is dramatic - a 32% increase from MY 2006/07 to MY 2007/08. It is estimated that approximately NZD80¢ (USD 0.62) per kilogram of the cost increase is due to the cost of the drought. While the volume of supplementary feed purchased next year is likely to decrease, prices for grains and silage are unlikely to moderate very much.

Consumption

MY2007/08

Post has revised the total domestic consumption estimate for MY2007/08 downward to reflect the reduction in dema nd from higher consumer prices.

Consumer Prices for Dairy Products Increase Dramatically

Prices for dairy products at the retail level have increased significantly over the last twelve months with butter showing the most significant increase. The price increases have been large enough and rapid enough to dampen demand. According to press reports, the demand for butter during the March 2008 quarter is down 12% from a year ago. Demand for cheese products is reportedly showing a similar trend.

Trade

MY2007/08 Exports

Post is revising its estimates for New Zealand exports downward slightly because of the drought. Compared to MY 2007/06, nonfat dry milk and butter exports are forecast to drop considerably while cheese exports are forecast to drop slightly and whole milk powder (WMP) exports are constant.

Exports Year to date

As shown in the table below, New Zealand exports of skim milk powder and butter have dropped considerably while whey exports have increased. The drought is a primary factor accounting for the decline in skim milk powder and butter. Exports of WMP are largely unchanged, which reflects New Zealand’s comparative advantage in production and the relatively high price for WMP vis a vis alternative products. While cheese exports have fallen slightly, exports could easily grow by 8-12% next year as production rebounds from the drought. Over time, cheese exports are expected to resume the trend established over the past fifteen years of annual growth in the order of 6-7%.

Further Reading

| - | You can view the full report, including tables, by clicking here. |

May 2008