Constrained global supply driving import competition

Globally, Australia isn’t the only country struggling with supply challenges. Cattle slaughter in Brazil and Argentina is down on year-ago levels, while New Zealand has also entered a seasonal low period in terms of cattle supply. Limited supplies and firm global demand are driving an upwards trend in export prices, with major import markets competing for product.

Furthermore, the new strain of African Swine Fever (ASF) across Asia poses an additional threat to food supply and will likely underpin elevated prices in the near term.

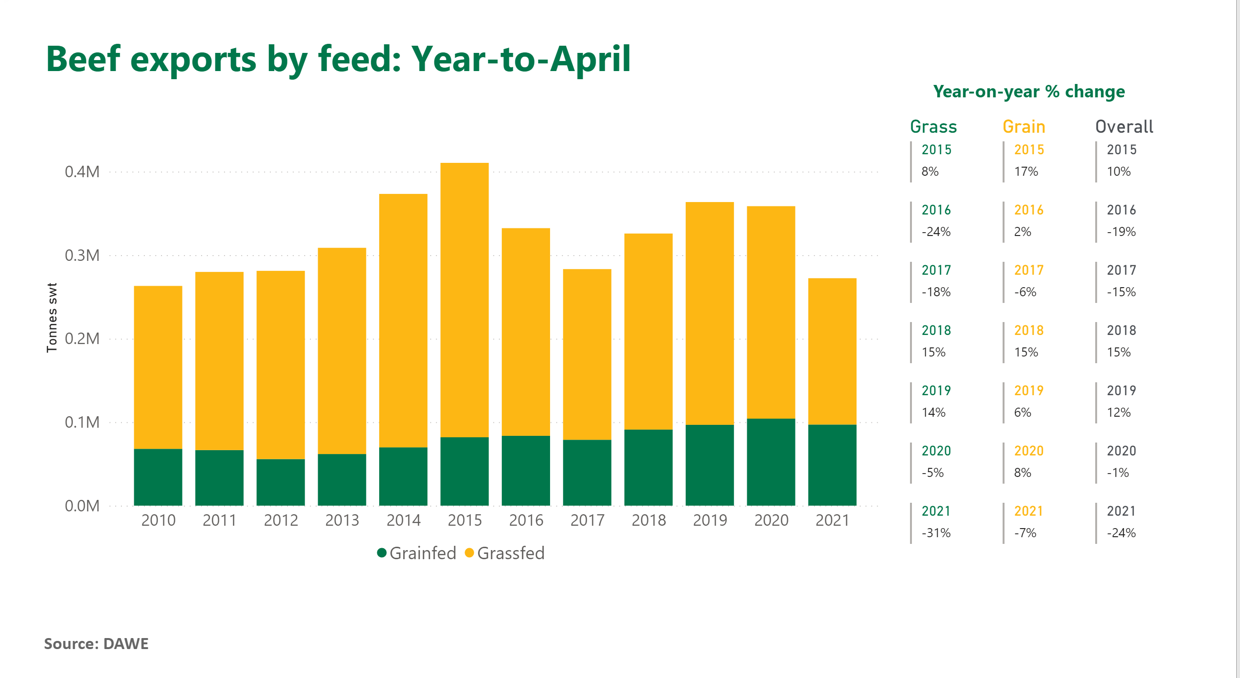

- Australian beef exports down 24% for the year-to-April

- Tight cattle supplies at a global level are impacting import prices

- Chinese beef imports up 20% for the first quarter of the year

Globally, Australia isn’t the only country struggling with supply challenges. Cattle slaughter in Brazil and Argentina is down on year-ago levels, while New Zealand has also entered a seasonal low period in terms of cattle supply. Limited supplies and firm global demand are driving an upwards trend in export prices, with major import markets competing for product. Furthermore, the new strain of African Swine Fever (ASF) across Asia poses an additional threat to food supply and will likely underpin elevated prices in the near term.

Australian beef exports in April declined relative to March volumes, reaching 72,500 tonnes shipped weight (swt), equating to a 22% decline on April levels last year. Feed supplies across major cattle regions are ample and have allowed producers to both retain female stock and limit the number of cattle they send for processing. While this is positive for producers looking to rebuild herds, the availability of exportable beef is constrained, with beef export volumes now back 24% year-on-year to reach just 272,000 tonnes swt for the year-to-April, well short of the 358,000 tonnes swt exported this time last year.

Across categories, grainfed beef exports remain relatively stable, back just 7% on 2020 volumes for the year-to-April. Comparatively, grassfed exports are now back 31% for the same period.

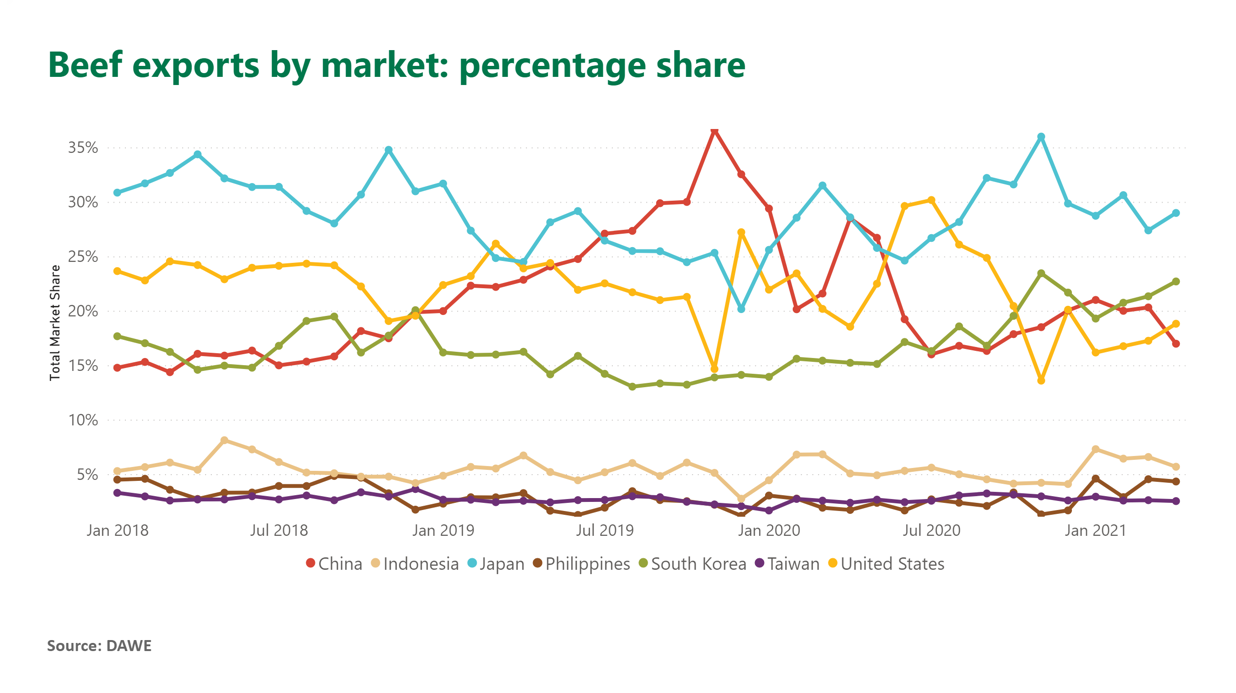

In April, the spread of Australian beef exports was characteristic of the trends seen in the past few months, with the majority of product heading to Japan and South Korea, while trade to China and the US remained subdued relative to historical levels. April beef exports to Japan were 18,500 tonnes swt (back 23% year-on-year), Korea reached 14,500 tonnes swt (up 14% year-on-year), the US took 12,000 tonnes swt (down 23% year-on-year) and China accounted for 10,800 tonnes swt (down 55% year-on-year).

US imported beef prices jumped upwards last week, as competitive offerings from Asian destinations pushed up values and challenged US importers. The reduction in beef supplies continue to affect the US market, particularly as buyers look to build inventory leading into the summer grilling season. Offerings from New Zealand have also been limited. With US beef processing already running at capacity, wholesale beef prices across the US have soared upwards in recent weeks.

Chinese beef imports were up 20% for the first quarter of the year, relative to 2020 levels. Firm demand from China continues to drive import prices, particularly as supply conditions are less than ideal for a number of major beef exporting nations. China continues to lean on Brazil, Argentina, Uruguay and New Zealand for beef supplies, with year-to-March imports from each market up 33%, 19%, 47% and 28% respectively.

Retail prices in Japan are also elevated off the back of tight supply and competition from other markets. This was evident in March, when the Japanese retail price for imported brisket was up 17% compared to the same period a year ago and the price of imported chuck roll was up 6%.

.png)

TheCattleSite News Desk