CoBank: Dairy could rebound from summer setbacks

Amid low milk prices and high feed costs, dairy farmers culled more cows to take advantage of record-high beef pricesDairy’s fortunes started the new year with a somewhat prosperous $21.60 all-milk price projection. Stymied by $13.77 and $14.91 Class III milk prices in June and July, USDA economists revised and lowered their 2023 all-milk price projections by a whopping $2.05 per cwt. by mid-year.

On the Class III front, multiple factors converged to force Cheddar blocks down from January’s $2.00 to the $1.40 per pound range by mid-June. Chief among them was strong Cheddar production as the Midwest region brought new cheese processing capacity online. As a result, output rose a collective 4.2% YoY by May.

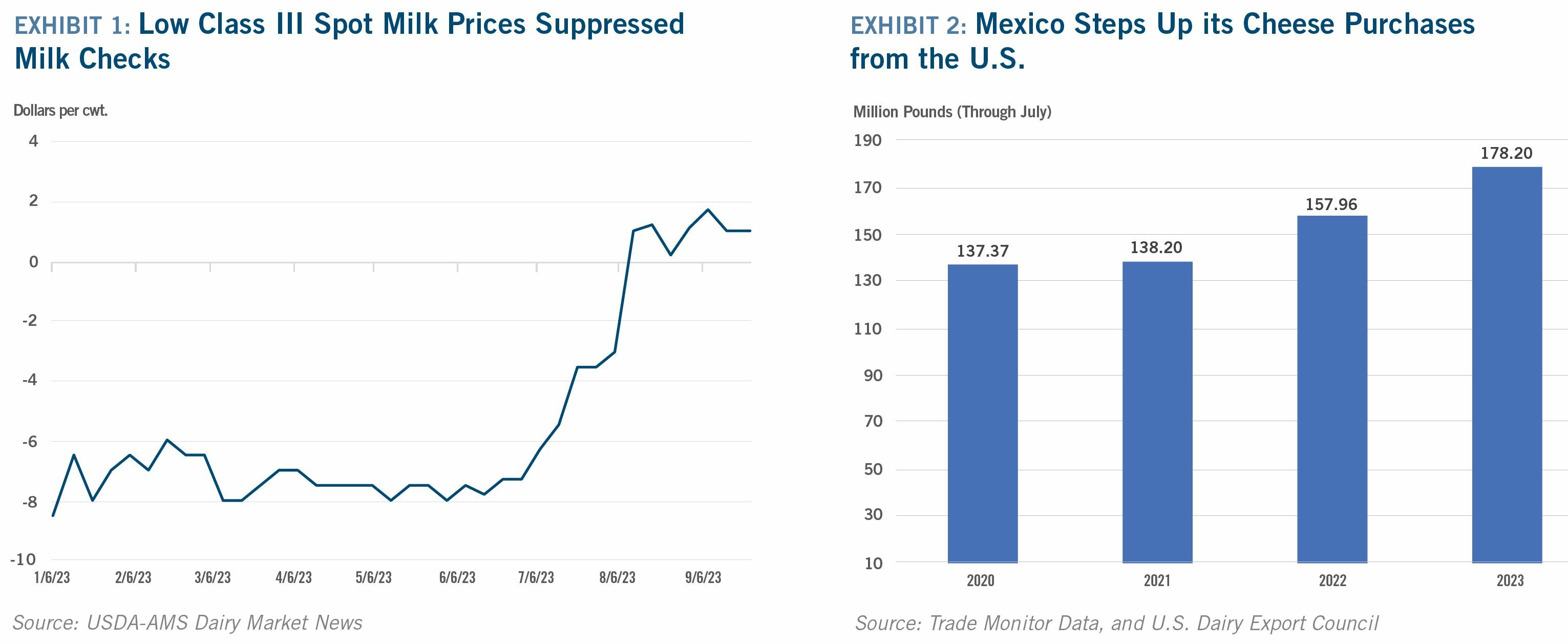

With cheese output booming and ample supplies of milk, Midwest Class III spot prices dropped to $6.50-$8.50 under federal order values. While these low spot prices traditionally take place in late winter and spring, this year’s swoon was well below the five-year average. Midwest Class III spot milk prices eventually turned positive in early August largely lifted by slowing milk production in both July and August.

Domestic cheese consumption has been holding its own as year-to-date usage climbed 1.3% versus last year. With retail cheese prices, July consumption jumped by 3%, the largest monthly gain of the year. The butter boom also continues as domestic consumption climbed over 8% again this year.

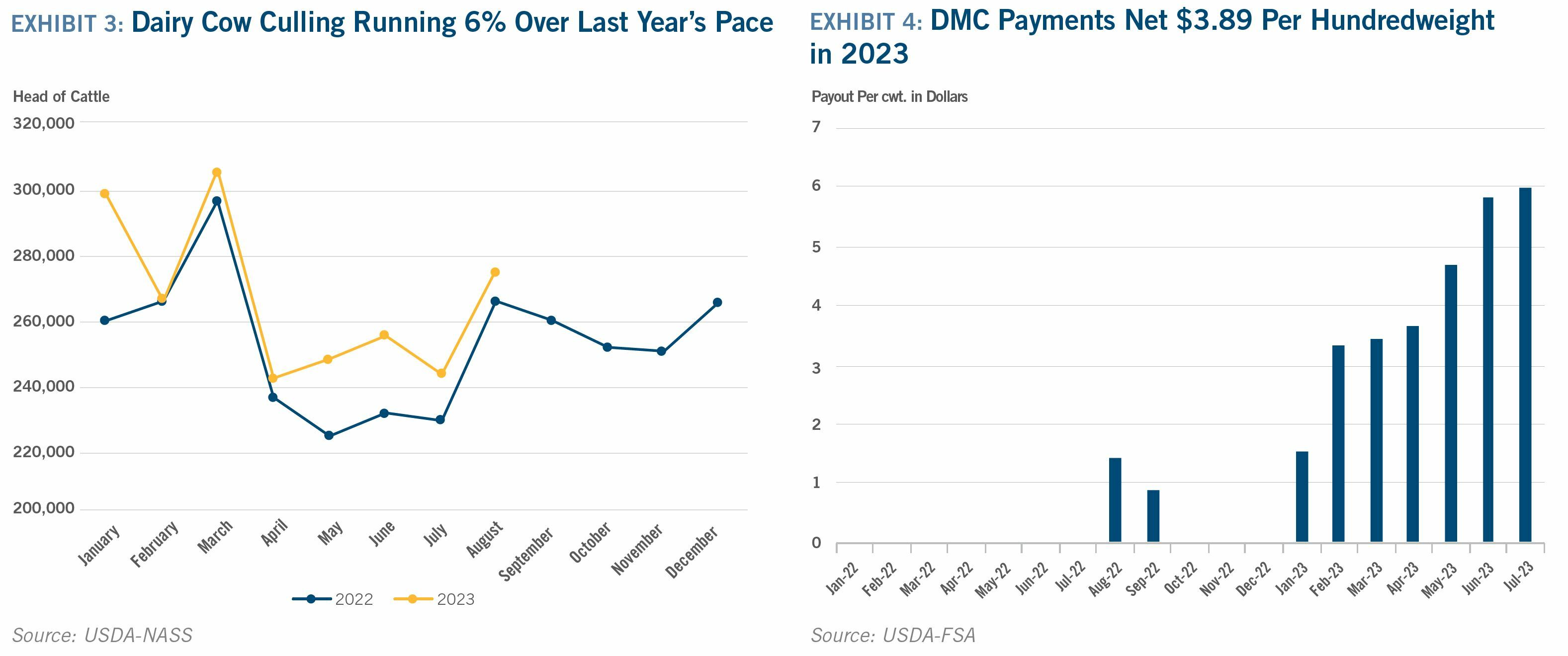

Unfortunately, fluid milk sales continue their downward spiral, off another 2.1%. That alone didn’t send farm mailbox prices downward, however. After back-to-back record dairy product export years, total milk solid exports were off 6% YoY. Overall, there was slowed import growth from China and stronger competition from both Europe and New Zealand. Additionally, U.S. cheese remains the highest price option among major exporters. As a result, U.S. dry whey exports fell 17% and cheese dropped 6%. The situation could have been far worse had it not been for Mexico’s stepped-up cheese purchases. Bolstered by a stronger peso, Mexico purchased 13% more cheese in the first seven months (Exhibit 2).

The combination of low milk prices and record beef prices caused dairy farmers to send more cows to packing plants (Exhibit 3). Through mid-September, 2.1 million head have been sent to slaughter. That’s up 108,000 head over last year. Moving forward, the pace of culling should back off with an improved milk price outlook.

The low milk checks could have levied a far worse toll had it not been for improved milk price mitigation strategies. These days between 55% and 65% of U.S. milk production has some form of price protection. For milk insured under the Dairy Margin Coverage program, an additional $3.89 per cwt. has been paid out to dairy farmers with over $1.13 billion paid out as of July (Exhibit 4). That payout is approaching 2021’s total record $1.19 billion payout.

Futures markets indicate that the final quarter of the year could be much better than the summer with a projected $17.30 Class III and a stronger $19.70 Class IV price. The biggest wild card for milk prices is China, the world’s leading dairy-product importer, which is mired in an economic downturn.