Are Global Dairy Prices Falling?

In the November edition of Dairy Co's Dairy market update, wholesale data shows global prices falling compared to the previous year.Wholesale markets, a mixed picture

Globally, wholesale prices for October showed skimmed milk powder (SMP) as the only product where prices were up on year earlier levels. Butter fell by $400/t between September and October to $3,800/t - $400/t (9.5 per cent) down on the previous year.

Whole milk powder (WMP) was also down by $200/t (5.7 per cent) compared to the previous year at $3,300/t. Part of the fall in WMP prices is likely due to a continuing fall in Chinese WMP imports. Imports have been falling yr/yr since June 2011 with September figures the lowest for nearly three years.

EU markets remained slightly firmer in comparison, with prices above those of the previous year despite falling from September. While raw milk supplies have been declining seasonally, butter stored under Private Storage Aid coming back onto the market boosted supply.

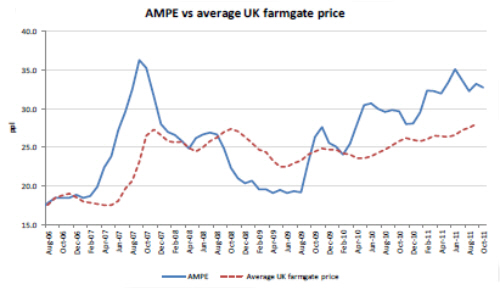

Dutch butter fell by €90/t in October compared with September to €3,940 but was still €170/t (4.5 per cent) more than October last year. Closer to home, UK wholesale markets have followed the EU trend with October prices still above those of the previous year. As a result of £100/t fall in butter from £3,600/t to £3,500/t, AMPE fell by 0.5ppl (1.5 per cent) between September and October to 32.8ppl.

In context

While UK markets have eased slightly, October AMPE is currently 4.75ppl more than the latest Defra farmgate price for September of 28.03ppl. However, it is likely that this difference will narrow when the October farmgate price is released as there were 28 price increases announced for October according to the DairyCo milk price league table.

Moving forward, much will depend on how milk production in the southern hemisphere progresses and what products this milk goes into. With China reducing WMP imports, there have been suggestions that New Zealand may look to switch milk into butter and SMP and may look to export more product to the EU in 2012.

New Zealand to expand further in 2012

New Zealand milk production in 2012 is forecasted to reach 18.45bn litres according to US attaches based in Wellington.

This would be 291m litres (1.6 per cent) above 2011 production, which is currently estimated to be a new record of 18.16bn litres. The forecasts assume ‘normal climate conditions’ and are based on the expectation of the dairy herd expanding by a further 110,000 cows and the trend of gains in productivity continuing.

As only five per cent of annual milk production is consumed in New Zealand either as products or liquid milk, changes in production levels will be reflected in exports. If demand remained stable, additional export availability from New Zealand could put downward pressure on global commodity prices.

However, recently the International Farm Comparison Network (IFCN) forecast that by 2025 global milk production will need to reach 874bn litres per year, to meet increased demand from a growing global population. Based on 2010 production levels, this would equate to an additional 12.9bn litres of milk being produced globally per year, approximately equivalent to annual UK milk production. On average, an additional 11bn litres has been produced per year since 1995, 62 per cent of which was in Asia, presenting the scale of the challenge to meet growing global demand.

Milk retail price battle - update

Since the retail price story in the last Dairy Market Update (20 October) there has been continued milk price activity from the leading multiple retailers. The latest DairyCo retail prices survey using ESA data has shown several retailers following Asda, by decreasing the price of their own-label milk.

During the week commencing 17 October, Tesco, Sainsbury and Morrisons reduced the price of their own label four pint poly-bottle from £1.25 to £1.18. These price changes have brought them level with Asda which reduced its price in the week commencing 10 October.

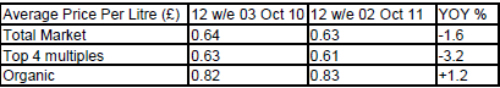

The table above shows Kantar Worldpanel data over a period of 12 weeks and shows the reduction in price amongst the top four retailers. The price data shown takes into account the promotional offers that may have been in place at the time to show the average price per litre (for instance the two for £2 offer).

The table also highlights the price point for organic milk, which stands at 83p per litre, which is 32 per cent higher than the average market price market of milk (63p).

In context

An organic food report recently released by Mintel showed attitudes towards organic products. It showed that only 30 per cent of consumers stated ‘they are prepared to pay more for organic food’. In the same survey 31 per cent of respondents said they ‘used to buy organic foods but have cut down over the last year to save money’. Which raises the question; will the retail price of organic milk need to change in order to compete with conventional milk?

PDO & PGI

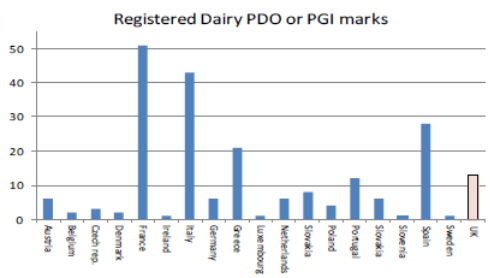

With a total estimated wholesale value of €14.2bn in 2008 (DG-Agri); Protected Designation of Origin (PDO) and Protected Geographical Indication (PGI) are becoming increasingly popular for food manufacturers looking to protect the particular geographical characteristics of their products.

The main difference between the two orders is that in the case of a PDO, all elements of production, processing and preparation must take place within the defined geographical region. A PGI allows some flexibility within this. Looking at dairy, the estimated value was more than €5bn (2008) with most EU-27 countries having at least one PDO or PGI registered.

As shown above, the UK has 13 registered dairy PDO or PGI orders with 12 for cheese and one for Cornish Clotted Cream. In addition, there are two current applications including one for Wensleydale cheese.

In context

These orders look into the whole product life-cycle with proven characteristics resulting from the terrain or abilities of producers in the region specified. Benefits from the granting of an order may not just be limited to the producers of a given product with them benefits spilling over into areas such as tourism. However, there has been opposition to these measures. Firstly opposition has arisen from competitors in other parts of the world engaged the production of similar products, for example, makers of Italian-style cheeses in the USA. Related to this is that if these orders are actively enforced; it could reduce the available supply of products and discourage consumers as prices would increase.

Dairy cow numbers continue to fall

Latest census figures from Defra show that the number of UK dairy cows fell by 33,000 (1.8 per cent) in June 2011 when compared to June 2010. There are now 1.81 million dairy cows in the UK herd, a decrease of 7.2 per cent (140,000 dairy cows) in the last five years.

Potential reasons for the reduction could be increases in cull cow prices and an increase in feed costs. Until September 2011 dairy sired cull cow prices had been steadily rising from 75.08p/kg in November 2010 to 110.06p/kg in August 2011, a 46.6 per cent increase.

Additionally, worry over feed and forage stocks may have led to early culling, with intensive energy rations and low energy ration prices increasing 15.8 per cent and 18.6 per cent respectively between September 2010 and September 2011. These factors have contributed to a 57.3 per cent increase in the number of dairy sired cull cows between September 2010 and September 2011.

Looking at the future, the number of dairy heifers aged one to two years increased slightly (0.4 per cent) to 542,000 animals, while the number of dairy heifers aged less than one year was 2.3 per cent higher than in 2010 at 538,000.