Canada's Farm Income Forecast For 2010 And 2011

2011 preliminary forecasts indicate a decline in farm income as increased crop and livestock receipts get offset by higher expenses and reduced programme payments, according to the latest forecast from Agriculture and Agri-Food Canada.Executive Summary

Canada's Farm Income Forecast is a measure of the financial strength of the agriculture sector and its contribution to Canada's economy. It represents a federal-provincial consensus on the outlook for farm receipts, expenses and net incomes.

2010

For 2010 Canadian farmers will see net incomes rise due to a decline in operating expenses and renewed strength in output markets, neither of which was foreseen at the beginning of the year.

In the second half of 2010 grains and oilseeds prices increased to levels that approached their peak of 2007-08, as a result of sustained growth in world feed demand for animal feed and supply constraints such as the imposition of export restrictions by Russia and Ukraine during the summer. This price jump helped mitigate a drop in receipts driven by reduced seeded acreage and lower production resulting from flooding on the Prairies. On the livestock side, cattle and especially hog prices rebounded in 2010 as North American producers marketed fewer animals in response to the low prices they faced in 2009, and as an economic recovery helped demand.

Total expenses declined in 2010, driven in part by lower costs for key inputs such as fertilizer, pesticides, feed and seed. The price declines for those products reflect supply and demand factors beyond the domestic market and the strengthening of the Canadian dollar since late-2009. Fewer seeded acres in Western Canada also contributed to reduced purchases of inputs. In addition, total interest expenses fell as lending rates dropped to historical lows.

Net Cash Income at the sector level will reach $8.9 billion in 2010 while farm-level average net operating income will be $50,077. Both measures show farm income slightly surpassing the peak levels seen in recent years.

2011

For 2011, our preliminary forecasts indicate that farm income will decline somewhat as increased expenses and reduced programme payments will more than offset increased crop and livestock receipts.

Crop receipts are expected to be slightly higher, as the price spikes in grains and oilseeds that took place in the second half of 2010 will still be felt in 2011. Livestock receipts are forecast to be higher in 2011, with prices for cattle and hogs having largely recovered from their lows in 2009. Nonetheless, net incomes of red meat producers will go down, as higher feed costs are felt.

Overall expenses will increase in 2011, in particular costs related to field crops. Unit costs for fertilizer, seeds, and pesticide are expected to rebound while quantities purchased will increase as unseeded/flooded acres on the Prairies are put back into production. Programme payments will decrease in part because AgriRecovery assistance related to flooding was paid only in 2010.

Although aggregate net cash income and average net operating income in 2011 are forecast to drop by 13 per cent, and 11 per cent, respectively, they follow a record year and in both cases will remain higher than the average for 2005-2009.

Besides net farm income, the Farm Income Forecast contains other indicators that measure producers' economic well-being. Those indicators suggest a positive situation. Average total income of farm families, which includes-non farm income, is forecast to reach $109,216 in 2011. At the same time, average net worth per farm is expected to reach $1.6 million, a 44 per cent increase over five years.

Agriculture and Agri-Food Canada's Medium Term Outlook indicates that many of the forces affecting farm incomes in Canada in 2010 and 2011 may continue over the next ten years. These include increasing world-wide demand for feed grains, a rising price of crude oil, a Canadian dollar near par with the American dollar, and Canadian population growth of 1.2 per cent per year with its implications for increased domestic food demand.

Methodology

Agriculture and Agri-Food Canada has finalized its farm income forecast for 2010 and 2011. This forecast is produced in consultation with provincial governments and Statistics Canada.

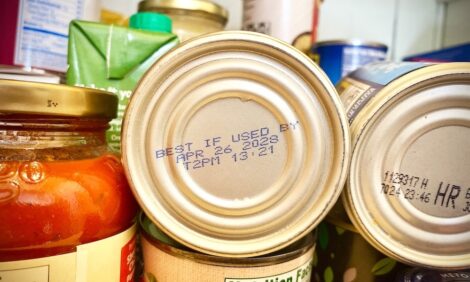

The farm income forecast is a federal-provincial consensus on the outlook for farm receipts, expenses, incomes and balance sheets in 2010 and 2011. This farm income outlook is based on information available up until mid-December, 2010, and is established using the same concepts and methods adopted by Statistics Canada for the purpose of farm income reporting at both the farm and aggregate provincial levels. The forecast is recorded on a cash accounting basis for the calendar year. Some of the more important assumptions, upon which the forecast is based, include:

- November estimates of field crop production published by Statistics Canada in December 2010

- An average USD-CAD exchange rate of 0.96 (1 CAD = 0.96 USD) for calendar year 2010 and 1.01 for calendar year 2011;

- An average West Texas Intermediate (WTI) crude oil price of USD 79 per barrel in 2010 and USD 85 per barrel in 2011;

- Preliminary data for 2008 from the Taxation Data Program forms the baseline for 2010 and 2011 farm level estimates

- Data and forecasts reflect information obtained up until mid-December, 2010

Farm level estimates are generated by the Canadian Agriculture Dynamic Micro-Simulation model (CADMS). The results can be used to compare average farm incomes and average farm family incomes between farm types and sizes. In addition, total family income illustrates the importance of non-farm income as a source of revenue for farm operations.

Data are collected at the individual farm business level, and include revenues and operating expenses associated with the farm business. Aggregate farm income measures provide the agricultural sector with overall performance indicators by province. The data collected and used in these calculations are consistent with the concepts used in measuring the performance of the overall Canadian economy.

Canada's agriculture sector is heavily dependant on trade. Uncertainty regarding future economic conditions, as well as unprecedented volatility in international commodity markets, could result in actual farm income differing from the forecasted estimates.

Highlights

2010 Farm Income Forecast

The year began with declining trends in grain and oilseed prices, a hog sector in crisis, stagnation in the cattle industry, and fears of input price increases because of volatile international markets. However, abrupt turnarounds in several areas have resulted in a sharp improvement in expectations and the forecast for 2010 is better than anticipated. This is mainly due to a decline in overall input prices, a recovery in the hog industry, rising grain and oilseed prices in the second half of 2010, and expected growth in off farm income and net worth.

Net operating income for the average Canadian farm (which does not include adjustments for changes in inventories and depreciation) is forecast to be a record high of $50,077 in 2010, 31 per cent above the 2005-2009 average of $38,238.

Net worth for the average farm, is expected to increase by 8 per cent to $1.5 million in 2010 relative to 2009. In 2010, total assets are expected to increase 7 per cent from 2009, to $1.8 million, with long-term assets expected to outpace the expansion of current assets for the average farm as land values increase. Total liabilities are also expected to increase 7 per cent to $344,156 in 2010, relative to 2009, as producers take advantage of record low interest rates.

Aggregate total cash receipts are forecast to be $43.4 billion in 2010, 6 per cent above the 2005-2009 average. Both crop receipts (-7 per cent) and program payments (-9 per cent) are expected to decrease while livestock receipts are expected to increase 5 per cent.

Net cash income is expected to rise 3 per cent, compared to 2009, to $8.9 billion. Despite a projected decrease in the expenses on inputs, the agriculture sector's net value added is expected to fall by 4 per cent in 2010, compared to 2009, to $10.8 billion as total value of production declines and depreciation increases.

Average total family income is expected to increase to $106,553 in 2010, up from the 2005-2009 average of $92,456. Other family income is estimated to increase 7 per cent from 2009 to $82,827 in 2010, which is 13 per cent above the 2005-2009 average of $73,100. The average family farm with sales under $250,000 is expected to earn most of its income from off-farm sources in 2010, while family farms with over $250,000 in sales are forecast to receive a greater portion of family income from the agriculture operation.

Crops 2010

The average grain and oilseed farm in 2010 is expected to earn $62,062 in net operating income, 42 per cent above the 2005-2009 average, and 3 per cent below the 2009 record high.

Excessive amounts of precipitation throughout the growing season adversely affected the production in western provinces and subsequently lowered crop quality. However, strong grain and oilseed prices in the second half of 2010 as a result of tightening global supplies and record production of corn and soybeans in Eastern Canada helped mitigate the drop in production faced by grain and oilseed producers in Western Canada. Also propping up incomes for grain and oilseed producers, were declining input prices and increases in program payments, which included $318 million in Prairie Excess Moisture Initiative payouts through the AgriRecovery framework.

For the average potato farm, net operating income in 2010 is expected to be $168,391 in 2010, a 22 per cent decrease from 2009. This is mainly due to decreasing potato prices in 2010, from 2009. However, net operating income in 2010 is still 13 per cent above the 2005-2009 average.

In 2010, the average vegetable farm net operating income is expected to increase by 8 per cent, relative to 2009, to $59,027, 20 per cent above the 2005-2009 average. Strong market receipts due to strong yields are forecast to outpace expenses reaching $376,576 in 2010, which is 12 per cent above the 5-year average.

The average fruit farm net operating income is forecast to rise by 23 per cent to $31,412 in 2010, 12 per cent above the 2005-2009 average of $28,034. Falling program payments and increasing expenses due to rising wages are offset by strong receipts.

Aggregate crop sector receipts are forecast to be $21.6 billion, after reaching a record high in 2009 of $23.3 billion. This represents a decrease of 7 per cent, compared to 2009, but it is still 16 per cent above the 2005-2009 average.

Livestock 2010

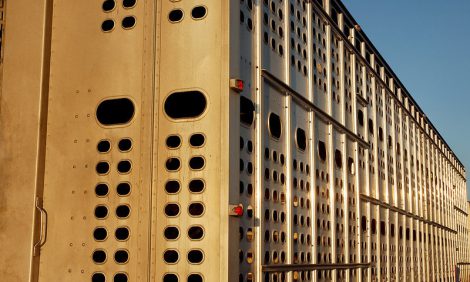

The many challenges still present in the livestock industry, including herd reductions, the strong Canadian dollar and Country of Origin Labeling (COOL) regulations in the US, are expected to continue to adversely affect livestock marketings. However, rebounding hog prices, which have been spurred by the global economic recovery and supply constraints in North America along with strong cattle prices, have helped the sector's bottom line along with low interest rates and feed costs.

Net operating income for the average cattle farm is forecast to remain stable at $11,608 in 2010, 2 per cent up from the 2005-2009 average. Tighter supplies and severe winter storms in US cattle feeding country in the early part of 2010 have helped prop up cattle prices in Canada despite a strong Canadian dollar.

Net operating income for the average hog farm is expected to be $150,861 in 2010, 147 per cent above 2005-2009 average. The hog sector is emerging from a prolonged trough in the hog cycle that has produced low returns over the past several years. Although hog producers are faced with the same export challenges as the cattle sector, expected higher prices and the exit of many unprofitable hog producers, partly spurred by the Hog Farm Transition Programme (HFTP), are expected to boost the net operating income for the average hog farm in 2010.

The average poultry and egg farm is expected to earn $147,143 in net operating income in 2010, a 23 per cent increase relative to the 2005-2009 average, due to forecasted rising market receipts and slightly falling expenditures on inputs in 2010.

Net operating income for the average dairy farm in 2009 is expected to be $111,322 in 2010, 11 per cent higher than the 2005-2009 average. While there is limited production growth in this mature market, gains in net operating income are expected due to an expected increase in market receipts and stable input prices in 2010.

Aggregate livestock receipts are forecast to increase to $18.8 billion in 2010, which is 3 per cent higher than the 2005-2009 average. The global economic recovery, strong prices and stronger US demand are forecast to help farm cash receipts rebound from the lows of 2009.

Programme Payments 2010

In 2010, programme payments are forecast to be $3.0 billion, a drop of 9 per cent from 2009. This decline in program payments is mainly due to a better than anticipated performance of the grains and oilseeds sector. As a result, lower payments to this sector are being triggered through the AgriStability programmes. Lower payments through AgriInvest are also forecast in 2010.

Increased payments through AgriInsurance and Waterfowl Damage Programme, along with higher support through the Agricultural Disaster Relief Programme under the AgriRecovery Framework (Pasture Recovery Initiative, Prairie Excess Moisture Initiative) will help to offset those lower payments mentioned earlier.

Operating Expenses 2010

In 2010, farm operating expenses are forecast to drop for the second straight year, declining $1.5 billion or 4 per cent compared to 2009. Fertilizer, feed, pesticide, interest and commercial seed costs are expected to significantly drop. Fertilizer prices are expected to decrease 19 per cent in 2010 relative to 2009, in response to low natural gas prices and the weak worldwide fertilizer demand due to the continuing struggling global economy. Also, interest rates paid for farm debts are projected to be down 11 per cent, as rates remain lower in an effort to maintain economic recovery.

Pesticide prices are expected to decline 8 per cent in 2010 due to steep price decreases for the Roundup herbicides as an off-patent farm pesticide maker has picked up registration for entering into the Roundup Ready marketplace. Commercial feed prices are also forecast to decline due to less costly feed crops. On the quantity side, the use of fertilizer, fuel, pesticides and seeds is projected to decrease as excessive rains in June led to severe flooding in the Prairies, leaving a large area unseeded, particularly in Saskatchewan.

2011 Farm Income Forecast

The forecast for 2011 remains relatively strong; however, some uncertainty remains. The productive capacity of the excess moisture afflicted areas in the Prairie Provinces, rising interest rates and commodity price variability are all factors that are expected to contribute to the uncertainty in 2011.

Net operating income for the average farm in Canada is forecast to be $44,171 in 2011, an increase of 16 per cent in 2011 compared to the 2005-2009 average but below the 2010 estimate of $50,077.

For the average farm, net worth is expected to increase by 8 per cent from 2010, to $1.6 million in 2011. In 2011, total assets are expected to increase 7 per cent from 2010 to $2.0 million, with the growth of long-term assets surpassing that of current assets. Long-term and total liabilities are expected to increase 5 per cent in 2011, from 2010.

Aggregate total cash receipts in Canada for 2011 are forecast to increase 2 per cent relative to 2010, to $44.3 billion, which is 8 per cent above the 2005-2009 average of $41.1 billion. Both crop receipts (+4 per cent) and livestock receipts (+3 per cent) are forecast to increase while direct payments are expected to drop 20 per cent.

Net cash income of the sector is forecast to decline to $7.8 billion in 2011 from $8.9 billion in 2010, but is still above the 2005-2009 average of $7.4 billion. As a result of expected rising expenses on inputs, the agriculture sector's net value added is expected to be $10.1 billion in 2011, down from $10.8 billion in 2010.

Average total family income is expected to be $109,216 in 2011, which is 18 per cent higher than the 5-year average. Other family income, on average, is forecast to be $88,288, an increase of 21 per cent relative to the 2005-2009 average. In 2011, the average farm family is expected to earn a larger portion of its total family income from non-farm sources than farm sources in 2011. Cattle farm families are expected to earn 3 per cent of their total family income from farm operations while grain and oilseed farm families are expected to earn 23 per cent of their total family income from farm operations.

Crops 2011

Low crop carry-over levels are expected into 2011, due to 2010 crop production constraints stemming from the flood in the Prairie Provinces. Average grain and oilseed farms are expected to earn $51,645 in net operating income as producers hold back marketings to build inventories. This is 17 per cent below the average net operating income in 2010, but still 18 per cent above the 2005-2009 average. In addition, larger harvested areas are expected for canola, soybean and corn crops in the medium term, as oilseed crushing capacity expands.

The decline in income in 2011 is compounded by an expected increase in input prices and a decrease in program payments; however, commodity prices are expected to rebound slightly, stimulating market receipts.

For the average potato farm, net operating income in 2011 is expected to climb 26 per cent to $211,835 from 2010, which is 42 per cent above the 2005-2009 average. In 2011, increased demand and tighter supplies is expected to boost potato prices, driving an 11 per cent increase over 2010 in average market receipts.

In 2011 the average vegetable farm net operating income is expected to be $56,288, 15 per cent above the 2005-2009 average. Market receipts are expected to increase in 2011 relative to 2010, while expenses and programme payments increase by 2 per cent and 10 per cent, respectively.

The average fruit farm in 2011 is expected to earn $34,248 in net operating income, up 22 per cent relative to the 2005-2009 average. In 2011, higher operating expenses are expected to be offset by higher program payments and climbing receipts.

Aggregate crop sector receipts are forecast to be $22.5 billion, a 4 per cent decrease relative to 2010 and 21 per cent above the 2005-2009 average.

Livestock 2011

The factors expected to adversely impact livestock producers in 2010 are anticipated to continue in 2011. Herd reductions, the strong Canadian dollar and Country of Origin Labeling (COOL) are expected to continue to negatively affect livestock marketings. Cattle breeding herds are expected to be restocked, leading to increased marketings by 2012. However, the strong prices seen in 2010 are expected to continue into 2011, as supply is expected to continue to be squeezed and demand continues to rise. The recent strength of livestock prices will be tamed by the continued strength of the Canadian dollar.

Net operating income for the average cattle farm is expected to be $5,639 in 2011. Tighter North American cattle supplies and rising demand are expected to exert upward pressure on prices. However, a strong Canadian dollar is expected to mitigate some of the upward pressure on cattle prices. Despite an anticipated increase in receipts, declining program payments and rising expenses are expected to be main contributors to the expected lower net operating income, relative to the 2005-2009 average of $11,412.

Net operating income for the average hog farm is expected to be $114,243 in 2011. Market receipts are expected to remain relatively stable as hog prices are forecast to level off and inventories continue to contract. Despite flat receipts, rising expenses due to increasing feed costs and falling program payments, the average net operating income is still 87 per cent above the 2005-2009 average of $61,131. Expected strong hog prices in 2010 and 2011 and the anticipated exit of struggling hog producers, partly spurred by the Hog Farm Transition Programme (HFTP), contribute to the large drop in expected program payments in 2011. Hog slaughter decreases slightly in the short term because of low margins before improving after 2012.

The average poultry and egg farm is expected to earn $162,478 in 2011, which is 36 per cent higher than the 2005-2009 average. Egg production is expected to increase by 2 per cent, as the average rate of lay increases. As feed costs (largely corn) are expected to increase by 25 per cent in 2011, chicken prices are forecast to go up by 10-15 per cent, boosting market receipts for the average farm by 13 per cent relative to 2010.

Net operating income for the average dairy farm is expected to be $115,276 in 2011, which is 15 per cent higher than the 2005-2009 average. Market receipts, which are expected to outpace expenses, are forecast to be 22 per cent above the 2005-2009 average, a 4 per cent increase from 2010, mainly due to an expected increase in administrated prices.

Aggregate livestock receipts are forecast to increase 3 per cent in 2011 relative to 2010, to $19.4 billion, which is 6 per cent higher than the 2005-2009 average. Stronger cattle and hog prices are expected in 2011 and US demand for Canadian cattle is expected to grow in 2011, given US supply constraints.

Programme Payments 2011

In 2011, programme payments are expected to reach $2.4 billion, a 20 per cent decrease from 2010. This can be mainly explained by a decrease in payments through AgriRecovery, AgriInsurance and ASRA. The lower payments under AgriRecovery ($19 million in 2011 compared to $416 million in 2010) can be explained by the nature of the program itself. Considering that the next disaster cannot be predicted, AgriRecovery payments are not forecasted.

Operating Expenses 2011

In 2011, farm net operating expenses are forecast to increase 6 per cent relative to 2010, due mainly to forecasted higher interest, energy, fertilizer and pesticides costs. The price of crude oil is forecast to average USD 85 per barrel in 2011, 8 per cent higher than the 2010 average as the global economic recovery continues. The prime business rate charged by the major banks in Canada is expected to be 3.79 per cent on average in 2011, up from 2.59 per cent in 2010, which is expected to increase interest expenses.

Pesticide and fertilizer prices are forecast to be higher in 2011 driven by rising global grain requirements. In addition, the use of fertilizer, fuel, pesticides and seeds are expected to rise to their normal levels in 2011 as the large area of unseeded acreage in the Prairies returns to production.