Dairy Markets Review

An assessment of the short to medium term outlook for global dairy products, prepared by Teagasc.Overview of current market situation

Global dairy markets have experienced substantial price swings over the last two years. In 2007 and early 2008, a range of factors initially gave rise to a record increase in world prices across the full dairy product range. However, this was then followed by an even more dramatic collapse in world dairy product prices over the last 12 months. Numerous factors, on both the demand side and the supply side, played a role in the evolution of world dairy prices over the last three years.

World milk production has fallen since 2005, with unfavourable weather impacting production in Australia, New Zealand, Argentina and Ukraine, while some countries also placed restriction on exports to world markets as a means of dampening domestic food price inflation. On the demand side, strong global consumption growth had been a consistent trend in dairy markets in the current decade. Rapid economic growth in developing economies and in crude oil exporting countries stimulated demand for dairy products. In addition, population growth, increased urbanisation and the adoption of western eating habits have also boosted consumption.

In 2007 dairy producers temporarily experienced an income boom, as costs remained relatively stable while milk prices increased. In addition, decoupled compensation became available for the price drop that had been expected under the Mid Term Review. As energy costs rose and the development of the biofuels sector continued, a surge in farm input prices followed and in the latter half of 2008 this offset the benefits for producers that the initial increase in dairy prices provided.

The next stage in the process saw a negative reaction in consumer and food ingredient demand to the increase in dairy prices over the course of 2008. Dairy product consumption per capita dropped around the world as consumers increasingly sought out value by buying cheaper products and smaller packets and by reducing domestic food waste through better monitoring of use by dates.

The economic and financial crisis which began to emerge in mid 2008, added further complexity to the dairy market picture. As income growth stalled in the face of recession, dairy product consumption contracted and global dairy prices fell dramatically in the second half of 2008.

Outlook for the short to medium term

The report focuses on the global dairy product production and consumption outlook and how this is likely to evolve in the period to 2015.United Kingdom

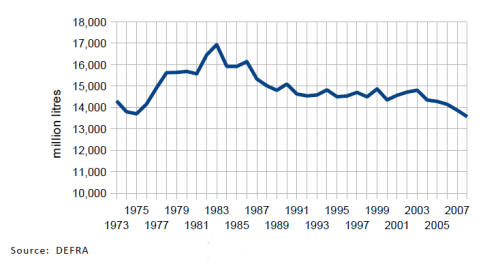

UK milk production has been in decline since the introduction of the milk quota system in 1984. In 2008, it reached its lowest level since the early 1970s. This is likely due to the dissolution of the Milk Marketing Boards (MMB) and the increasing power of retailers. Low milk prices have led to low returns, and a perceived lack of interest in the agriculture sector on the part of the UK government has also contributed to a lack of farmers confidence.

Outbreaks of bovine spongiform encephalopathy (BSE) and foot and mouth disease (FMD)created uncertainty and limited investment in the sector. With one fifth of milk producers in the UK being tenants, this mitigates against investment and long term planning. Cow fertility is also an increasing problem and is leading to an increase in the replacement rate and increased costs.

The UK has recorded a quota surplus in only one year (1997/98) in the current decade and the quota deficit has been growing rapidly over the last four years, now standing at -1300 million litres. Projections and opinions are mixed on how milk production in the UK will evolve over the medium term. Milk production in the UK may continue to decline with farm numbers falling, increasing retailer influences over producer prices, and an inability by producers to adjust towards cheaper production systems.

A more positive outlook would be that UK milk production will stabilise. Dairy farms will become more adapt at allowing production to be stable despite low margins per litre and international competitiveness will improve due to the depreciation of the sterling against other European currencies.

One third of Northern Ireland (NI) milk production is now processed in Ireland, should milk production in Britain continue to decline then there could be an increasing requirement to source milk and dairy products from NI.

Cheese is the UK's largest dairy import category. The UK is one of the largest markets for cheddar in the world. Given the reduced self-sufficiency discussed above, UK cheese production is expected to decline over the medium term. Similarly, reduced UK butter production is also expected in the future, with import demand for this product consequently increasing. In recent years, consumer demand for butter has increased at the expense of other spreadable fats and margarine at retail level, and this trend is forecast to continue.

Overall, contracting UK production could cause retailer pressure on farm gate milk prices and farm margins to dissipate and, along with a tighter production/consumption situation, could allow for better dairy product and producer milk price prospects than would otherwise exist. It seems that the UK's dairy import requirements will increase over the medium term.

European Union

In spite of the presence of milk production quotas, the EU dairy market is characterised by an excess of production over consumption. In 2008 EU milk self-sufficiency was 109 per cent. Third country imports are small relative to total consumption and are limited by tariffs barriers, which protect the EU market and allow internal EU prices to exceed prices on the world market.

Nevertheless, special import arrangements allow for a range of imports into the EU by other dairy exporters: New Zealand has 75,000 tonnes of butter, 4,000 tonnes of cheese for processing and 7,000 tonnes of cheddar, all at reduced tariffs. Australia has 500 tonnes of cheese for processing and 3,711 tonnes of cheddar also at reduced tariffs, while Canada has 4,000 tonnes of cheddar, again at reduced tariffs. In addition to the above concessions, there are several non-country specific quotas for reduced import tariffs covering 11,360 tonnes of butter; 84,000 tonnes of assorted cheeses and 69,000 tonnes of skimmed milk powder. There are numerous bilateral trade arrangements between the EU and other countries, normally at zero duties. These cover cheese from Norway and South Africa as well as miscellaneous concessions to Switzerland, Turkey and ACP countries.

Exports subsidies have been used by the EU to make it possible to export excess production to third countries at prices that are lower than internal EU prices. Intervention is used at times of market weakness to remove additional volumes from the market when consumption is depressed.

The Mid Term Review (MTR) of the CAP and the Health Check which followed, reduced the level of intervention support and set in train a process of milk quota removal. Some 40 per cent of the EU milk supply is used for cheese production and a further 30 per cent is used in fresh dairy products. These two product areas have been the drivers of growth in dairy consumption in the EU over the last decade. The remaining 30 per cent of EU milk production is mainly used in the manufacture of butter, powders and casein.

Due to higher than anticipated international demand, it has only been in the latter half of 2008 and into 2009 that producer prices have fallen below the price levels that prevailed at the time of the MTR negotiations. The decrease in producer milk prices in 2008/09 has had an impact on monthly milk production around the EU. In spite of the increases in the EU milk quota the monthly production profile in the 2008/09 quota year is only slightly ahead of the 2008/09 quota level. Weak domestic consumption and exports in 2008 and 2009 have led to extended intervention measures and a restoration of dairy export subsidies, which had been set to zero by the EU Commission in 2007.

Within the EU the impact of the recession and the downturn in international dairy prices is being felt at present and EU intervention stocks are building. EU butter stocks at almost 80,00 tones are equivalent to about 4 per cent of EU annual production, while EU skimmed milk powder stocks at 250,000 tonnes are close to 30 per cent of annual EU production (August 2009). The impact of intervention purchases and export subsidisation over the short term is to prevent an even greater decline in EU producer milk prices. However, stockpiled intervention products have to be released to the market at some future point. The EU Commission's selling off strategy for these stocks will influence market prices over the short term.

The short term outlook for the EU dairy sector is that production will be below milk quota in 2009/10, that stocks will continue to feature through the rest of calendar year 2009, and that any recovery in EU prices is likely to be very gradual. The presence of substantial intervention stocks will delay the recovery in EU prices, even when international prices begin to rise. Depending on the supply response to the current low prices this situation may persist into 2010. A higher than average annual reduction in the EU dairy cow herd could tighten supplies, but it is not clear for how long producers in financial difficulty will try to persevere in the current downturn. To some extent this will depend on their own resolve, but the willingness of banks to advance credit in a tight cashflow situation will also be a consideration.

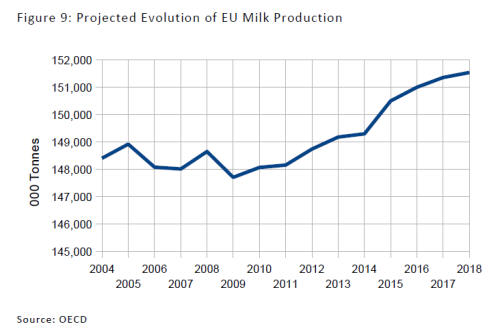

Projections point to a decrease in milk production in the short term (although possibly less than suggested in the OECD projections above) followed by a medium term recovery, but prices are likely to be weaker than the levels projected in advance of the economic crisis. Over the period to 2015, EU milk production should recover as prices improve and EU milk production should keep pace with the annual milk quota increases agreed in the Health Check. The trend of declining milk production in southern Europe and the maintenance of production at quota levels in much of northern Europe will continue.

Growth in EU cheese and fresh product consumption, the drivers of growth in the EU dairy sector, will be weak due to lower income growth prospects. EU dairy export competitiveness will need to recover by 2013 or the EU may find it politically difficult to eliminate export subsidies.

The European Commission view is that the elimination of export subsidies is a realistic objective as the EU butter surplus will decline over the period to 2015 due to lower levels of butter production and greater production of cheese and higher value added products. This perspective is consistent with a view that intervention and export subsidies will not be required in the future.

However, this view of how the EU market will evolve is not consistent with the opinion of some market experts who consider that the EU butter surplus will continue into the future, as EU butter production will not decline to the extent envisaged by the European Commission. The basis for this view is an expectation of increased availability of butter fat due to the increased production of lower fat dairy products in the EU.

United States

In general, import barriers have limited dairy trade with the US. To a large extent the US has been more or less self sufficient in dairy products and has not traditionally had a sizeable exportable surplus. However, a characteristic of US dairy markets over the last four or five years has been that production has grown at a faster rate than consumption. The growth in US dairy consumption has been running at about one per cent per annum, while production has grown by 2.5 per cent per annum. This has created an exportable milk surplus of around three to five million tonnes of milk. The origins of the US dairy export surplus were high margins as illustrated in the high US income over feed cost (IOFC) on dairy farms which prompted strong growth in US milk production.

It is important to note also that the US dairy exports to the world market are less reliant on export subsidies than are dairy exports from the EU. The recent weakness of the US dollar relative to the currencies of other key exporters has aided the competitiveness of US dairy exports.

The farm scale of US milk production has been growing rapidly. While the average herd size is 120 cows, the emergence of large scale herds in excess of 2,000 cows continues. At the current rate of progress just 500 farms will soon produce one third of US milk production. The emergence of these large operations suggests that this may now be the most economic means of producing milk in the US. The expansion of large scale operations may be constrained in the future by environmental concerns, or a lack of access to water or the unavailability of low cost labour.

In reaction to the current low level of milk prices, the US government has subsidised exports and has announced that it will raise US support prices from August through to October 2009.

The short term dairy outlook in the US is not good from a US dairy farming perspective and the consensus is that US production will contract slightly in 2009 and 2010. The outlook over the medium term will depend on a recovery in milk prices and affordable feed costs. More modest production growth of 5 to 6 million tonnes is achievable in the period to 2015 and this will be mainly channelled to cheese production for consumption on the home market. Exchange rate movements will impact on international competitiveness and the weak outlook for the US dollar will create an environment to support US dairy exports.

Australia

There is a strong view that the recovery in the Australian dairy sector will be very weak. The importance of access to water for the Australian dairy sector cannot be understated. Drought conditions have been an ongoing problem for producers in Australia over the last decade. Access to irrigation water has become a key concern and has affected both yields and herd investment decisions in Australia. In Northern Victoria, urban areas are taking precedence over agriculture and water allocations are being redirected to towns in the region. Water stocks in the Murray-Darling Basin remain low and water access rights will continue to be restricted. Estimates suggest that it may take a full decade to replenish these water reserves.

Milk production in Australia has now begun to show a recovery for the first time in a number of years, up two percent in 2008/09, but the country's exports remain significantly below those of a decade ago. Drought conditions have caused some producers to exit and many of those that remain have reduced their herd size. Projections suggest that milk production in Australia will not recover to its 2002 peak until 2015.

New Zealand

New Zealand (NZ) is the largest dairy exporter in the world, with over 95 per cent of its milk production being exported. New Zealand production has not been affected to the same degree as Australia, but adverse weather conditions still depressed production by as much as three per cent in the 2007/08 milk year, with a resultant impact on export capacity. NZ milk production recovered well in the 2008/09 year and finished the year eight per cent ahead of the 2007/08 year. Commentators expect NZ production to continue to grow over the short to medium term. This growth will be driven on the one hand by increasing yields, through increased feed supplementation, while farm conversions to dairying from sheep finishing on the South Island will continue to provide additional land for dairy cows. At present dairy cow numbers are falling on the North Island. The average annual rate of NZ milk production growth since 1990 has been about four per cent.

However, it is considered that expansion will be more costly in the coming decade than in the current decade and that production growth rates will be lower as a result. Consequently growth of 3 percent per annum is possible over the short term with growth easing back to 1 percent per annum by 2015. Given the grass based production system in NZ, weather can be expected to exert an impact on production, which will add further variability around these average annual growth rates.

While the NZ milk production system retains its very low cost, grass based focus, there is evidence of a trend towards increased utilisation of concentrate feed and fertiliser and this is impacting on production costs. In this context, milk and feed price relativities will become more important and this may have negative implications for the resilience of some elements of the NZ dairy sector in periods when milk prices are low.

In international trade terms, exchange rate movements are of critical importance for the New Zealand dairy sector. The NZ dollar has appreciated by almost 20 per cent against the US dollar since the beginning of 2009. This has impacted on the competitiveness of the country's exports and further depressed world dairy price when expressed in NZ dollars terms.

Overall, barring adverse weather, it would seem that New Zealand will maintain its position as the leading dairy exporter. Export growth will continue, albeit at a declining rate.

South America

South America is growing in importance as a dairy exporting region. Aside from the US, over the last five years Brazil and Argentina have recorded the largest growth in net exports of dairy products.

When South American dairy processors seek to export further afield, their export market tends to be Africa rather than Asia. In turn this puts South American dairy exports in direct competition with EU dairy exports to markets in Africa. South American dairy exports are less likely to compete directly with New Zealand exports to dairy markets in Asia.

Brazil

Traditionally Brazil was a net importer of dairy products. Brazilian dairy exports have grown through the decade and Brazil has had a net export position in dairy products since 2004. Whether Brazil continues to increase its net exports will depend not alone on its production growth, but also on the expansion of Brazilian dairy consumption.

Economic growth in Brazil will occur at a higher rate than in more developed economies and this will mean that consumption growth should be strong. Reduced income inequality and the growth in the size of the Brazilian middle class should also aid the growth in the consumption of dairy products.

Some projections indicate that the production growth will accelerate further in the period to 2015 and by then a doubling of production relative to 2000 is possible.

Argentina

Government intervention has led to a loss of confidence among producers in Argentina and this has resulted in a stagnation in milk production in recent years. High international prices boosted exports in 2007 and 2008. This prompted inflationary pressure in the domestic dairy market and led to the introduction of export taxes by the government.

Over the medium term production growth is projected to re-emerge, allowing milk production to increase by 20 per cent over the period to 2015. However, strong growth in cheese and whole milk powder consumption will absorb much of this increased milk production. Argentina should be able to maintain its current level of net exports in the period to 2015, but may not become a bigger player on the world market.

China

GDP in China is now ten times the level it was in 1980 and the Chinese market has become a major element of global consumption growth in dairy products over the last decade. By 2015 Chinese whole milk powder consumption could reach almost 4 times the level in 1998.

The expansion of Chinese milk production over the last decade has been extremely rapid. While it has not matched the pace of growth in dairy product consumption, it has meant that only some of the growth in Chinese dairy consumption has stimulated increased imports of dairy products. Over the medium term Chinese imports of cheese and skimmed milk powder will increase, while the growth in Chinese exports of whole milk powder will continue.

The recent melamine contamination of infant formula in China led to increasing infant formula imports, and these import volumes should be maintained until such time as consumers' faith in indigenously produced infant formula is restored.

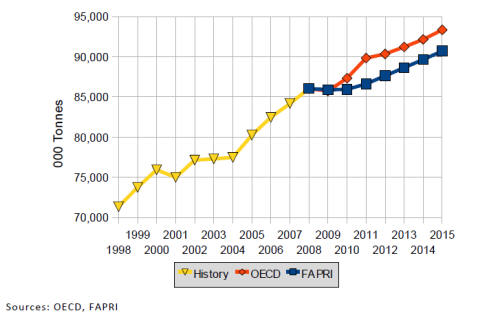

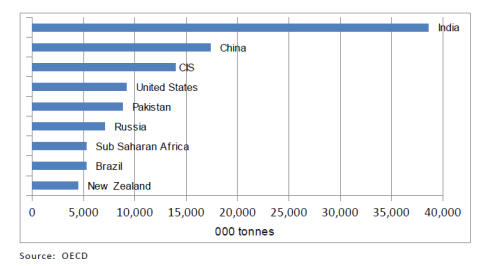

India

India is the world's largest milk producer and in absolute terms its growth in milk production over the medium term is projected to considerably exceed that of any other major milk producing region.

Animal productivity in India's traditional milk production regions continues to improve. However, consumption growth in India will absorb much of this increased milk production due to growing population, additional demand for value added products and increased incomes levels among the middle classes.

India's net trade in dairy products is unlikely to change considerably over the medium term.

Russia

Commentators agree that milk production in Russia will recover over the medium term. Low yielding cows are being replaced by higher yielding imported stock and considerable government investment is being made in a new dairy cattle breeding programme. For food security reasons Russia would like to boost its self sufficiency in dairy products from just over 70 per cent at present to 95 per cent. A milk production target of 37 million tonnes has been set for 2012. There are mixed opinions as to whether this target will be achieved.

Global summary

Russia and the other former Soviet republics (CIS) will remain the largest butter importers. Sub-Saharan Africa and Algeria will remain the main whole milk powder importing regions and imports are expected to grow substantially. Mexico, Algeria and China should increase their imports of skimmed milk powder. Imports of cheese by Russia and Mexico in particular should increase over the period.

External factors

Weather: Weather events will continue to contribute to dairy product price volatility.

Energy prices and input prices: Rising energy prices will have an impact on dairy production costs and dairy demand.

Exchange rates: Exchange rate movements will impact on export competitiveness.

Macro economic and population growth: The rate of recovery in dairy demand will depend on the recovery in global economic growth.

Agricultural policy and trade policy changes: Policy issues remain to be decided and will impact on the outlook for the dairy sector.

Environmental policies and consumer preferences: Environmental concerns will exert an increasing influence on agriculture, including the dairy sector.

Renationalisation of dairy demand: The renationalisation of dairy demand would have an adverse impact on dairy exports.

Nutrition and health agenda: The health benefits of dairy product consumption may be undermined by legislation on labelling.

Animal welfare concerns: Animal welfare concerns related to food production continue to grow among consumers in the EU. It is not easy to consider how these concerns will evolve or how these concerns will impact on dairy trade.

Further Reading

| - | You can view the full report by clicking here. |

October 2009