Animal Genetic Markets in EU Member States

The EU animal genetics market is important for US exporters. According to a report prepared by Alexis Gough from the United States Department of Agriculture (USDA) Foreign Agricultural Service, the EU is expected to regulate animal cloning in the foreseeable future, while in the U.S., FDA already put out legislation at the beginning of 2008.Differences between these regulations could lead to problems for U.S. genetics exports. Therefore, this report focuses on livestock genetics markets in the EU Member States.

Introduction and purpose

This report was drafted in order to obtain a better understanding of the EU livestock genetics market and anticipate potential problems in the future for U.S. genetics trade. As genetics trade is generally a large export for the United States, and the EU a major market, it is important to determine the size of the EU market in livestock genetics and the U.S. market share.

Furthermore, it is important to understand the EU genetics market in light of the current cloning debate. As of January 2008, cloned animal products were approved for food in the United States.1 It is believed that there is not any food on the United States or EU markets from cloned animals due to an ongoing voluntary moratorium. 2 Currently, the EU is in the midst of determining how to regulate these products. How the EU will decide to regulate cloning and cloned animal products, may have a significant impact on U.S. animal product exports. U.S. genetics will likely be among the first products impacted.

The EU imports a variety of livestock genetics from the United States including bovine (cattle), porcine (pigs), ovine (sheep), caprine (goats), and equine (horses). Products that are internationally traded are tracked using Harmonized System (HS) Codes. While it would be interesting to determine the EU market for each of these species, the EU and the United States combine several species’ genetics under one code and therefore it is not possible to determine exactly how much of one species’ genetics enters the EU based on the current HS Coding system.

The major HS categories the United States tracks in the trade of livestock genetics are: bovine semen, non-bovine animal semen, dairy cattle embryos, and non-dairy cattle embryos. In contrast, the EU tracks only bovine semen and “other” under the heading “animal products.” This lack of detailed coding is not of much consequence as the largest U.S. export in livestock genetics is bovine semen.

Non-bovine genetics are certainly exported to the EU; however, the market is small. For example, although approximately 40% of all meat consumed in the world is pork3, there is little porcine semen traded because it must be used fresh and there are significant losses in freezing the semen.4 The United States is not a major exporter of caprine and ovine species because the EU and Australia are the most important producers.

Livestock Genetic Market Comparison

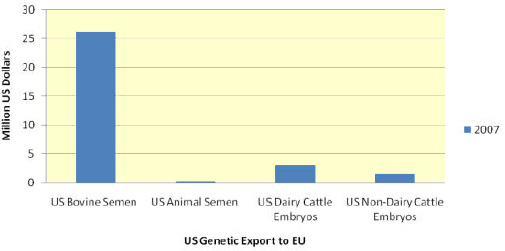

Figure 1: Comparison of U.S. livestock genetic exports to the EU – bovine semen & others

Based on official U.S. export data (see Figure 1 above), U.S. bovine semen represents 85% of the total U.S. genetics exports to the EU. Other animal semen exports to the EU represent less than 1%, dairy cattle embryo exports represent 9.6%, and non-dairy cattle embryo exports represent 4.7% of the total U.S. genetics exports. Because the EU import market for non-bovine genetics is significantly smaller than bovine genetics, this report focuses on bovine semen exports from the United States.

Background Law

Livestock genetics are regulated through a variety of EU directives and decisions. (To view the actual legislation, follow this link to the European Commission website:

http://ec.europa.eu/food/animal/semen_ova/index_en.htm.) It is worth noting that the United States and the EU have a veterinary equivalency agreement (VEA). However, animal genetics are currently still under evaluation in the VEA. While it is not applicable now, it is something to keep an eye on because equivalency agreements trump legislation.

Current Economic Situation

US Bovine Semen Exports to EU - 5Y

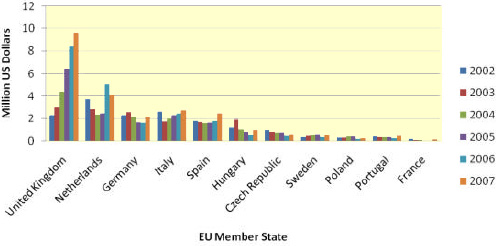

Figure 2: Five Year Official U.S. Bovine Semen Export Data

U.S. export data shows that the market has increased every year in the recent past– increasing by over 2 million US dollars in 2005, and over 3 million US dollars in both 2006 and 2007 from the prior year. EU import data also shows that U.S. livestock genetics imports have increased over the past six years. Data received from the U.S. National Association of Animal Breeders (NAAB) – a U.S. livestock genetics federation believing to represent approximately 95% of U.S. livestock genetics – also indicates growth each year since 2004. (No data prior to 2004 from NAAB was received.)

Data drawn from Global Trade Atlas 2002 – 2007

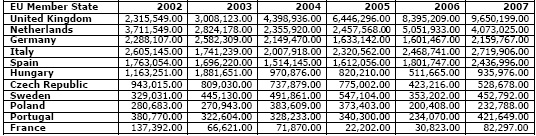

The top ten markets over the past six years for U.S. bovine semen exports are: the United Kingdom, The Netherlands, Germany, Italy, Spain, Hungary, Czech Republic, Sweden, Poland, and Portugal. (See Figure 2 above.) Based on the data, the U.S. relationship with the United Kingdom is important. Exports to the United Kingdom were over two times those to The Netherlands, which represents the second greatest market for U.S. bovine semen exports, in 2007.

Each country in the top ten has generally increased imports from the United States over the past six years with a few deviations here and there. For example, The Netherlands decreased imports from 2006 to 2007; however, the 2007 numbers are still well above those of 2005. Also, though Germany, Hungary, Czech Republic, Portugal, and Spain all display downward trends for a portion of the last six years, 2007 was a strong year and the numbers increased.

France is included in Figure 2 above because, as one of the major member states, it was expected to have a larger U.S. import market. However, all official U.S. data indicates otherwise.8 This may be because U.S. customs data indicates point of entry rather than final destination. Poland is included in Figure 2 because U.S. industry has noted Poland as an emerging market; however, industry has also stated that it can be difficult to trade with.

Total Bovine Semen into EU: 2002 - 2007

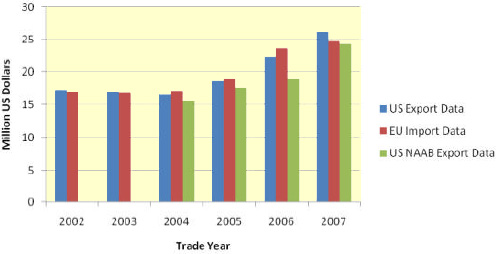

Figure 3: Bovine Semen into the EU market in 2005, 2006, and 2007 – Comparison of

three sources

Depending on the source tracking bovine semen into the EU, the data is different, as figure 3 illustrates above. The chart above includes U.S. export data, EU import data, and industry data provided by NAAB. NAAB data indicates less U.S. market share than either the United States or EU data. Noting that NAAB does not represent all exports to the EU may reconcile the inconsistency with official report data. The disparity between official U.S. data and official EU data is small considering the high volume of trade in this market. Taking into account the potential for reporting error, possible transshipment, and the possibility that each entity has different year end dates, the data reported by both the EU and the United States seems quite close.

Conclusion

The EU genetics market is important and continues to offer good export opportunities for the U.S. genetics industry as it is a large market. How the EU regulates animal products through cloning legislation, import legislation, etc in the future may impact the U.S. genetics market share in the EU.

Further Reading

| - | You can view the full report by clicking here. |

January 2009