Developing a Sustainable Smallholder Dairy Stratergy

Rising commodity prices around the global are providing a backdrop against which investment in agriculture in developing countries is more conducive than ever before, reports proceedings from the Regional Office for Asia and the Pacific Food and Agriculture Organization of the United Nations.The dairy sector is no exception; in fact, dairy prices, starting in late 2006, were among the first commodity prices to rise and the structural factors underpinning these increases, in particular the elimination of export subsidies, will maintain prices at relatively high levels over the medium term. Consequently, it is an opportune time to organize this workshop which focuses on the development of a regional strategy for smallholder dairy development.

In anticipation of generating guidance on best practices in sustainable smallholder dairy development that feed into the development of an effective strategy, lessons learned in the region need to be reviewed and analyzed. These lessons need to identify possibilities for increasing productivity, scaling up and/or replication of specific models and to identify specific entry points for the various stakeholders, whether they be producers, processors, policy-makers, or donors.

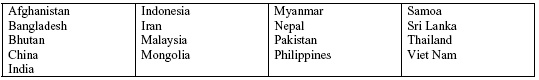

Both FAO and the Animal Production and Health Commission for Asia and the Pacific (APHCA) have a long standing commitment to smallholder dairy development and aim to provide regional guidance to stakeholders, through the identification of contextually “appropriate” policies, programmes and activities on sustainable development of smallholder dairy sectors. The organization of this workshop, financed partly by the Common Fund for Commodities (CFC), which combined the considerable expertise of over 50 experts from 17 countries around the region, shaped the regional strategy and investment plan for smallholder dairy development.

The approach for the strategy development process needed to be practical, based on lessons and input from the region, bankable and actionable; a roadmap enabling localized, targeted and tailored investment approaches. It needed to be a two-tiered and dual approach, emphasizing the importance of regional knowledge networking and resource mobilization that feed into national and localized intervention, while distinguishing between immediate and medium-term action.

The following document highlights the process and supportive information generated to craft the regional strategy. It is our hope that the information in the proceedings and the investment opportunities outlined in the strategy framework itself, which was finalized subsequently to the workshop, will set the stage for looking forward in terms of resource mobilization for the sector.

Introduction and background to the workshop

The context

Dairy consumption in Asia and the Pacific has more than doubled in twenty-five years, rising 4 percent annually to reach an estimated 248 million tones in 2008, more than one third of global totals. Nearly four-fifths of these gains have been in South Asia which accounts for 60 percent of the region’s bovine and ovine populations and for 20 percent of global milk consumption.

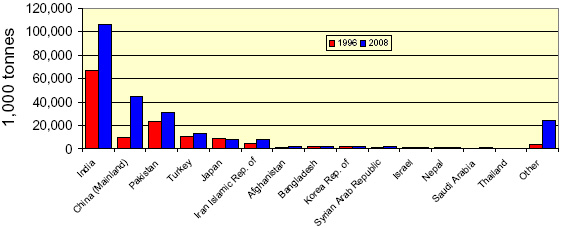

80% of Asian milk production gains since 1996 in China, India, and Pakistan

In 2006, a possible long-term structural adjustment in international dairy markets shocked market participants. This adjustment was characterized by tight global supplies and high prices as a result of the elimination of EU export subsidies for dairy products. Combined with long-term drought in Australia and a potential long-term investment slow down in that industry, these developments hold unprecedented opportunities for smallholder dairy operations in many developing countries. This is particularly true in Asia, where over 80 percent of dairy animals are raised by backyard or small-scale farmers who are a critical and unique ingredient in the region’s ability to maintain robust gains in milk production.

Local responses to growing consumption needs

Translating into opportunities for local producers, strong consumption gains in Asia over the past 10 years have supported the dairy sector. In fact, production gains in Asia have accounted for nearly 60 percent of global totals over the past decade. Growing demand by both urban and rural consumers in South Asia, a region of strong dairy traditions, was supplied by smallholders holding 2-5 cows; these are the producers who reputedly account for nearly 80 percent of regional milk production.

Characterized by a long historical tradition of both urban and rural milk consumption accompanied by strong informal rural milk market systems, consumers in South Asia consume nearly 60 kg/caput/annually (compared to the 96 kg/global average). However, the explosion in consumer acceptance of dairy products over the past decade has been in East and South East Asia where per capita consumption levels are generally one-third the levels of South Asia.

Coming from a low base characterized by low traditional preferences for fluid milk, double digit consumption gains in have been witnessed in countries like China and Viet Nam. These gains have been fuelled by growing incomes, changing diets and demographic trends which favor more western diets and strong generic promotion of milk products, including the promotion of school milk programmes.

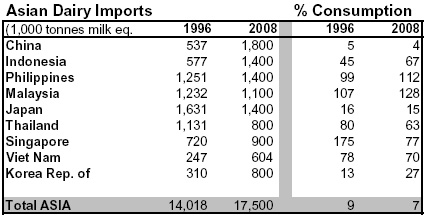

The role of imports in supplying local consumption

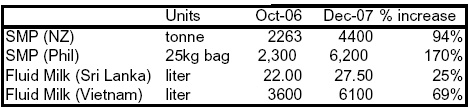

Asian, a region where GDP growth is estimated at 5-6 percent annually, constitutes an important market for the major dairy exporters, dominated by New Zealand, the EU, Australia, the US, and increasingly Argentina. While the region’s dairy product imports, particularly those of milk powder, have nearly doubled over the period, from 10 to an estimated of 17.5 million tones in 2008, the import dependency of the region has remained stable at nearly 9 percent. However, higher dairy product prices in 2007 and 2008 have pushed up import prices and FAO recently estimated that dairy product imports by developing countries will reach nearly US$25 billion in 2008. This is fuelled by a twothirds increase in import prices and, in combination with escalating prices for basic food stuffs such as maize, rice, and vegetable oils, raises regional concerns about food security.

Regional averages, however, tend to mask local realities and, in fact, while dairy product imports by South Asia, limited by strong consumers preferences for fresh milk, availabilities of local product and barriers to imports, constitute only 1 percent of domestic consumption, imported milk products into the South East Asian region supply nearly one-quarter of domestic requirements. When calculating dairy imports as a share of processed milk, this share jumps to over 90 percent in some countries.

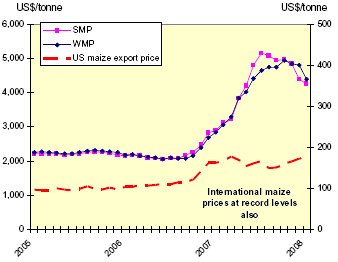

International milk powder prices move to unprecedented levels.....

In fact, Asia imports constitute more than half of global totals in milk products, and in countries like Sri Lanka, the Philippines, and Viet Nam, where tariff levels are very low and consumers are familiar with and favor reconstituted milk products, import dependency has reached over 80 percent. In China, a country which has witnessed doubledigit consumption gains over the past decade, imports constitute only 6 percent of total consumption. However, with imports estimated at nearly 2 million tonnes, China constitutes the largest dairy product importer in the world, followed by Mexico, Russia, Egypt, Indonesia, Malaysia and the Philippines.

The opportunity …….

International market prices of dairy products, rising well over twice their levels of one year ago, hold considerable opportunities for future dairy development in Asia. While prices of internationally traded milk powder are expected to gradually subside from their historical peak of near US$5,000/tonne in late 2007, the perceived competitiveness of large holder dairies heavily reliant on increasingly higher priced imported inputs is expected to erode. Increasingly large processors in the region are gravitating towards local suppliers of fresh milk, and in many regions, this implies stronger institutional linkages with smallholder producers, the characteristics of which differ by country and by local conditions within countries.

In some countries, depending on their linkages with international markets and the substitutability of fluid milk with reconstituted/UHT milk, domestic prices have been rising. This affords interesting opportunities for local dairy development. In some countries, however, smallholder participation has been constrained by government administered pricing schemes for milk and/or strong monoposony power by processors and/or collusion in price setting.

Changes in dairy prices since late 2006

The challenges……

To ensure broader stakeholder engagement in current market opportunities for dairy, it is clear that the opportunities for smallholder dairy producers can only be understood within the wide range of influencing factors: economic, institutional, commercial, legal, technological and social. However, effective strategies for enhancing the contribution by smallholders to growing livestock product demand is complicated by the fact that the specific constraints/opportunities facing the sector differ not only by country but by specific localities.

Consequently, useful models of small and large-holder milk producers, which are characterized by the specific linkages within the value chain, need to be reviewed and analyzed. It is particularly important that the enabling factors which are critical in successfully forging linkages between smallholder suppliers, processing facilities and traditional markets for fluid milk and other locally acceptable dairy products be identified, weighted and ranked. The selection and promotion of acceptable models need to be based on local conditions, market access, cultural factors and consumption patterns. These models could range from enterprise-driven smallholder dairy operations in the Philippines and Viet Nam, to cooperative development in South Asia, to strengthening opportunities for subsistence farmers in Bangladesh.

The workshop

Responding to the urgent need to stimulate investment opportunities for smallholder dairy producers in Asia, the Animal Production and Health Commission of Asia and the Pacific (APHCA), FAO, and the Common Fund for Commodities (CFC), organized a workshop1 on smallholder dairy development in Chiang Mai, Thailand from February 26-29th, 2008.

Representing 17 countries in the region, approximately 50 participants representing national government agencies, cooperative societies, dairy industry groups, independent research institutions, private companies and consulting firms and private sector dairy producers participated in the 4-day workshop.

The objective of the organizers of the workshop, with the assistance of the regional stakeholders, was to develop a dairy strategy which:

- is recognized and endorsed by donors/policy makers as a regional and “actionable roadmap” to action on smallholder dairy development;

- leads into a regional network on smallholder dairy development which provides best practices, guidance to regional stakeholders; and,

- generates commitment by governments/industries to work within the network to prepare national action plans on dairy development.

The workshop was opened by Dr. Hans Wagner, FAO’s Senior Animal Production and Health Officer in Asia and Secretary of APHCA. He welcomed all the participants on behalf of APHCA and briefly outlined the expectations of the workshop. He also expressed appreciation to Dr. Sakchai Sriboonsue, the Director General, Department of Livestock Development who participated in the opening ceremony as well as Francesco Gibbi, the representative of the CFC, who reaffirmed the commitment of the CFC to dairy development in the region.

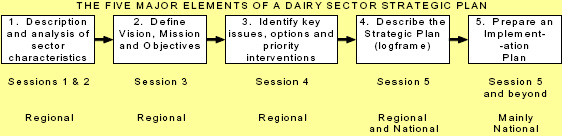

Mirroring the five main elements of strategy development depicted in the diagram above, the workshop structure moved from identifying trends/development in the region to brainstorming sessions which laid the groundwork for an “actionable, bankable” regional strategy for dairy development. Session 1 of the workshop reviewed the dairy environment in Asia through country specific background papers. In particular, general lessons from 9 FAO-commissioned “lessons learned case studies” were reviewed in a context of general dairy development trends, both globally and regionally. Specific results from three detailed value chains studies (India, Viet Nam, Philippines) were presented, followed by an overview of smallholder dairy development in Bangladesh and Mongolia (drawing similarities in the two countries despite the disparities in climate and resource bases), followed by an overview of dairy development in China, one of the fastest growing dairy markets in the world.

To better understand the competitive factors affecting smallholders’ ability to compete in markets which are increasingly characterised by competition with larger operations and processors, who have over the past decade relied heavily on imported milk powders, FAO presented a competitiveness framework for the smallholder dairy sector. This framework, tested in the three value chain case studies, reviews and analyses the related ability of value chain participants to respond to market opportunities, upgrade to meet new market requirements, address challenges posed by international competition, and to provide sustainable livelihoods to value chain participants through the competitiveness of the smallholder dairy enterprise.

Subsequently, workshop participants, in Session 2, 3, 4, and 5, through a process of group work and plenary sessions, defined the vision, mission and objectives of the dairy sector strategic plan, and identified key issues, options, and priority interventions which were placed in the context of a draft strategy logframe. The final regional strategy for smallholder dairy development can be found at the following website:

http://www.aphca.org/reference/dairy/dairy.html.

December 2008