Market Outlook for the Dairy Sector

By the Commission of the European Communities. This report provides the European and world market outlook for the dairy sector.

INTRODUCTION

In June 2003 the Council reached an agreement on a number of changes to the EU dairy policy. The most important elements were:

- symmetric reduction in intervention price: 25% for butter (from €328.20 to 246.39/100 kg) and 15% (from €205.52 to 174,69/100 kg) for skimmed milk powder (SMP);

- partial compensation for intervention price cut for dairy farmers: a direct payment of €24.49/100 kg of quota and a supplementary payment per Member State equivalent to approximately €11/100 kg. Such compensation is paid for the total of national quota as at 1999/2000. Originally the coupled payments had been programmed in Agenda 2000 at a lower level. The payments are to be decoupled at the latest in 2007;

- discouragement of butter intervention: by introducing the possibility to open a tender for intervention buying-in after 30 000 tonnes at fixed prices have been bought in;

- expiration of production quotas on 1 April 2015;

- postponement by one year of the gradual quota increase of 1.5% in three steps of 0.5% for 11 Member States, as already foreseen in Agenda 2000, by one year. The increase corresponds to 1.4 million tonnes of milk;

- reduction of the super levy: in four steps from €35.63/100 kg in 2003/04 to €27.83/100 kg from 2007/08 onwards.

Coinciding with the start of the dairy reform in 2004, 10 new Member States joined the EU. This increased the EU base quota by 18.5 million tonnes and added 80 million consumers. Furthermore, in accordance with the accession agreements a restructuring reserve of 0.67 million tonnes was established for eight of the new Member States. This additional reserve was added to their national quotas on 1 April 2006. In 2007 a further two new Member States with total quota of 4 million tonnes joined the Union, bringing the total amount of quota for the EU-27 to 142 million tonnes.

Thus, by 1 April 2008, further to 103 million consumers, 24.5 million tonnes of additional quota will have been added to the EU total since 2003.

The aim of the 2003 dairy reform was to increase competitiveness and market orientation. It was intended that by reducing the guaranteed price for butter and SMP these products would be less attractive to produce and this would give the industry an incentive to produce more value added products like cheese and fresh dairy products. Increasing the quota at the same time would encourage additional production, facilitate restructuring of the sector and encourage entrance into the sector by young farmers.

It will be recalled that the Commissions' proposal for the 2003 Reform was to increase quota by 2% on top of the 1.5% increase already agreed in Agenda 2000. In the June 2003 compromise, however, the Council declared that "No additional quota increase in 2007 and 2008 will be decided now. The Commission will present a market outlook report once the reform is fully implemented on the basis of which a decision will be taken."

Apart from the last scheduled quota increase of 0.5% in 11 Member States on 1 April 2008, the 2003 reform is now implemented and this report reflects the Commission's market analysis as requested by the Council in June 2003. The report effectively addresses the question of whether the market offers enough opportunities for additional quantities of milk to be supplied, without leading to increased public support in the short and/or medium term, were the production limits to be expanded for all 27 Member States.

EU MARKET OUTLOOK: 2007–2014

The medium-term baseline for milk supply and production of dairy products presented here is based on the DG AGRI report "Prospects for agricultural markets and income in the European Union 2007–2014", published July 2007. The report is based on market and policy information available at the end of June 2007 and assumed an unchanged policy environment. The full report can be found on internet at the address below:

http://ec.europa.eu/agriculture/publi/caprep/prospects2007a/index_en.htm

The main trends are described below and presented graphically in Annex 1: "BASELINE SCENARIO."

Milk production in the EU is forecasted to remain rather stable between 2007 and 2014. It may increase slightly in the short term as a reaction to higher milk prices. However, after 2009 total milk production is expected to decline gradually due to a steady decline in subsistence production, mainly in the New Member States. On the other hand milk delivered to processors is expected to increase mainly due to shift from direct sales to deliveries in the new Member States.

Cheese consumption is foreseen to remain the main driver of EU dairy production. From 2007–2014, an additional cheese production of 679 000 tonnes is expected. Consumption is expected to grow by 771 000 tonnes. Cheese consumption is predicted to grow very fast in the New Member States: +35%. EU-15 cheese consumption also continues to grow (+5%), clearly at a much lower pace. While imports are expected to increase only marginally, EU cheese exports are expected to go down. The additional 771 000 tonnes of cheese consumption would require approximately 6.2 million tonnes of milk equivalents.

Consumption of fresh dairy products is the other driver of dairy production in the EU. There are two sub-trends. On the one hand the consumption of drinking milk is decreasing. On the other hand consumption of fermented dairy products increases. It is expected that total consumption will continue to increase annually by 0.5% or 0.25 million tonnes of milk equivalents. This means an additional milk consumption of 1.75 million tonnes in 2014.

Consumption of butter is expected to decrease further, despite a slight increase in recent years. Production of butter is expected to decrease faster, due to the larger uptake of milk fat in cheese production and a lower fat content in raw milk. This means that exports will be reduced gradually. In 2014 it is expected that the EU will be close to becoming a net importer of butter. Intervention stocks are not expected to reappear.

Skimmed milk powder production is seen as decreasing over the forecast period, as more proteins are used in cheese and in fresh products. As the production is projected to come down and consumption expected to remain stable the exports are expected to be reduced. The EU will become a small net exporter of SMP by 2014. Intervention stocks are not expected to reappear for SMP either.

Whole milk powder, unlike most other EU dairy products, is largely produced for third country markets. However, other suppliers of WMP to the world market are more competitive than the EU. This is expected to lead to a gradual reduction of WMP production, as well as a reduction of the exports. WMP consumption is expected to remain stable.

In summary, it is forecast that between 2007 and 2014 1.75 million tonnes additional milk will be needed to satisfy growing consumption of fresh dairy products and 6.2 million tonnes for growing cheese consumption. Consumption of SMP and WMP is forecast to be stable. This means that 8.0 million tonnes of milk is needed to satisfy increasing internal demand alone. In essence, therefore, the market opportunities for the EU dairy sector are very positive.

WORLD MARKET OUTLOOK: 2006–2016

World production of milk has been increasing on a continuous basis. Since 1998, milk production has been growing at a rate of at least 10 million tonnes per year. This trend is expected to continue.

Figure 7.1 – World milk production

Only 7% world milk production is used in products traded on the world market. Most of the milk produced in the world is consumed in the same region, mainly in the form of liquid milk. Traded dairy products are those that, unlike liquid milk, can be stored for a certain time: milk powders, butter(oil) and cheese. Also the EU only exports a relatively small part of its milk production to third countries (9% of milk solids in 2006). EU imports of dairy products are small (1% of milk solids) due to import tariffs.

The outlook for the world market is analysed by the Organisation for Economic Cooperation & Development (OECD) working jointly with the Food & Agriculture Organisation (FAO) and the Food & Agricultural Policy Research Institute (FAPRI). The comparison of both their studies and the EU's own analysis can be found on the address below:

http://ec.europa.eu/agriculture/publi/caprep/prospects2007a/index_en.htm

| Table 7.1 – Expected world market developments 2006–2016 | ||||

| Projected price for 2016 ($/tonne) | Price difference 1996–2006 2006–2016 | Production and consumption (annual increase) | Trade (annual increase) | |

|---|---|---|---|---|

| Butter | 2 200 | +24% | +2–2.3% | +2% |

| Cheddar | 3 000 | +38% | +1.3–1.8% | +2.5% |

| SMP | 2 600 | +40% | +0.7–1.8% | +0.5–3% |

| WMP | 2 500 | +35% | +2% | +1.7% |

| Source: Agricultural commodity markets – Outlook 2007–2016. | ||||

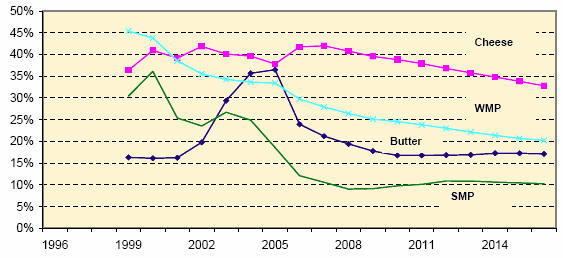

The graph below, based on FAPRI, shows that the EU dairy industry will have to give up market share on the world market as consumption increases on the internal market consumes a larger share of the milk produced.

Figure 7.2 – Share of EU-25 in world dairy

Source: FAPRI (2007)

In summary, average prices for dairy products on world markets are expected to increase substantially during the coming decade compared to the past decade. FAPRI and OECD foresee world dairy output and consumption growing moderately over the next years. The world market outlook for dairy trade is very positive, especially for cheese. Despite this global demand growth, the Commission's baseline foresees a decrease in EU cheese exports, due to the current limitations of the quota system that prevents milk production to expand.

INCREASE OF MILK QUOTAS BY 2% AS FROM 2008

Contrary to the uncertainties which prevailed in 2003, there is now greater clarity on the development of the market post-reform and two successive enlargements. The Commission is therefore in a better position to analyse the likely impact of a 2% quota increase as originally proposed in 2003, were it to be proposed today in the context of 27 Member States.

An assessment has been made of the impact on the dairy sector of such an increase, assuming that 2% additional quotas will be fully used, i.e. 2.84 million tonnes additional milk. The higher quota levels are valid from 2008 onwards. The detailed results of this analysis are presented in Annex 2: "deviations from baseline."

Compared to the baseline in chapter 6, the price of milk is expected to fall by 4%. However in the baseline an increase by 7% is foreseen.

For dairy products there is a shift towards more cheese production. Initially this matches additional demand, which is higher due to lower prices for cheese. Towards the end of the period it is foreseen that exports will increase again compared to the baseline. This means that the reduction of exports of cheese to the world market as foreseen in the baseline, is partly neutralized by the additional milk production.

For butter it is expected that production will increase, but only to a limited extent as part of the extra milk fat is used in additional cheese and fresh dairy products demanded due to reduced prices. Initially butter consumption will increase due to lower prices and exports will increase as well, due to the lower prices and the increased competitiveness on world markets. This effect will be less pronounced towards the end of the period.

SMP production is expected to increase significantly as a result of which the EU will increase exports to sell the additional quantity.

Both for butter and SMP, the extra production, should be possible without further market support.

The analysis shows that additional milk production of 2% offers producers more opportunity to meet market demand, either internally or externally, without overcharging the existing intervention scheme.

While the analysis assumes the full utilisation of the 2% increases in quotas the real impact on production would likely be more limited in the light of recent EU quota fulfilment rates.

CONCLUSIONS

Between 2003 and 2007, expanding cheese and fresh milk production absorbed an additional amount of 5.5 million tonnes of milk, while overall milk production remained stable. According to the analysis developed in the previous pages, between 2007 and 2014, an additional supply of about 8.0 million tonnes would be needed to meet growing internal demand, while, with quota unchanged, raw milk production is not expected to increase. Moreover, the outlook for the world market is positive. The study made to assess the impact of a 2% increase of milk production inside the EU leads to the conclusion that the market offers ample opportunities for absorbing such an additional quantity. While the analysis assumes that the 2% quota increase is fully utilised, the actual impact on production is likely to be more limited, taking into account the current situation where national quotas are not fully utilised in a number of Member States. The Commission in responding to the Council request to provide a basis on which a decision can be taken regarding an increase in quotas, concludes that the 2% increase, as originally proposed as part of the 2003 reform, may be implemented starting from 2008.

Further Reading

| - | You can view the full report by clicking here. |

December 2007