Global protein growth to slow as beef and pork contract - Rabobank

Seafood, poultry lead gains while disease and trade weigh on 2026

According to a RaboResearch report, the global animal protein industry is set to experience a slowdown in production growth in 2026, driven by both cyclical and structural factors. Seafood and poultry will lead growth, while pork and beef production will contract. The sector faces challenges from disease outbreaks, trade disruptions, and sustainability pressures, demanding strategic adaptation and technological integration from industry players.

Global production trends to diverge across species

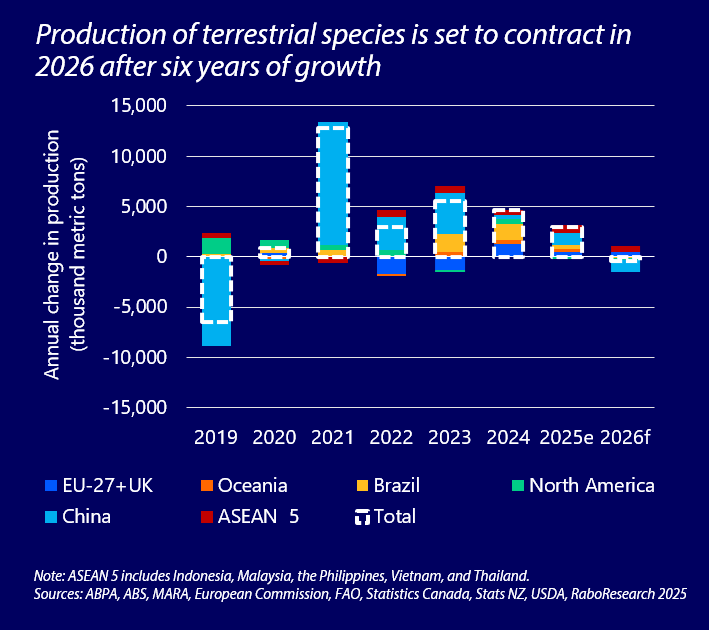

Growth in global animal protein production will continue to slow in 2026. Seafood and poultry will emerge as the primary drivers of production growth, while pork and beef production are expected to contract, marking the first reduction in global terrestrial species output in six years. This slowdown is influenced by both cyclical factors, such as shifts in North American and Brazilian cattle markets, and structural factors, like China’s efforts to rebalance its pork market.

Industry could face rising costs… and pressured margins

“While we expect feed costs to remain steady, lower protein supplies, rising volatility and trade costs, and disease pressure will weigh on margins,” said Éva Gocsik, global strategist for animal protein at RaboResearch.

Processors may face ongoing challenges around capacity utilization, as well as trade disruptions resulting from tariffs and other protectionist measures. All of this could raise costs, pressure demand, and ultimately squeeze margins.

“In both mature and developing markets, a focus on increasing efficiency and productivity will be critical at the farm and processor level," she said.

Economic and consumer dynamics point to price sensitivity

According to Gocsik, with global gross domestic product growth projected to decelerate, consumers are likely to become increasingly price-sensitive, altering their consumption patterns. At the same time, the rising use of glucagon-like peptide-1 agonists (GLP-1s) is also likely to influence dietary choices.

“Price pressures within animal protein categories may lead consumers to trade down or switch between proteins, while consumers seeking protein-rich foods will potentially boost animal protein demand," she said.

Global trade shows resilience amid disruption and uncertainty

Despite disruptions, animal protein trade has shown resilience, with strategic front-loading, like shipments of Brazilian beef into the US, helping to sustain volumes amid volatility and shifting tariffs that are reshaping global flows. Meanwhile, supply-demand imbalances continue to seek equilibrium, a trend that is likely to persist in 2026. Geopolitical tensions and evolving policies will continue to influence trade, but new trade agreements may provide a boost.

Disease continues to challenge production and trade

Disease outbreaks have also disrupted trade, squeezed margins, and pressured productivity. Disease outbreaks such as African swine fever and avian influenza continue to disrupt trade and squeeze margins. Combined with emerging diseases like New World screwworm and Bluetongue, these challenges are driving greater adoption of biosecurity measures and increased focus on new approaches to managing disease pressure, though implementation remains complex.

Sustainability is key to risk management, and technology offers solutions

In an uncertain operating environment, sustainability-related risks linked to climate and nature are increasingly critical. Regulatory momentum is pushing sustainability to the forefront of strategic planning for animal protein companies. Technology, particularly artificial intelligence, offers potential benefits for managing operational risks and advancing sustainability goals, though investment remains weak. While not all AI applications will transform the industry, strategic integration into existing workflows could spark meaningful progress in a sector that is traditionally slow to adopt new technologies.

“Maintaining consumer trust is paramount. In times of heightened risk, consumers continue to prioritise animal welfare, supply availability, price, food safety, and quality, and these demands are driving advancements in transparency and traceability,” explains Gocsik.

Regional outlooks

North America: Pork production growth will be constrained by disease and limited sow herd expansion. Broiler production will grow due to lower feed costs, while beef production will fall as the cow herd transitions from liquidation to rebuilding.

Brazil: Beef, pork, and chicken exports are heading toward a new record, with lower feed prices boosting domestic competitiveness.

Southeast Asia: Herd rebuilding will drive pork production growth, but disease remains a challenge. The poultry industry is set for strong growth, supported by export demand.

Australia & New Zealand: High cattle inventories will maintain elevated Australian beef production, while sheepmeat production recovers. New Zealand beef supply will improve, supported by strong global demand.

China: Pork production will decline due to herd contraction, while poultry output slows as production growth outpaces demand.

Europe: Pork production growth will continue at a slower rate, with poultry production rebounding despite avian flu risks. Beef production will stabilize, though supply remains tight.

“As the animal protein sector navigates these evolving dynamics, companies must pursue diversification and consolidation while adapting to shifting consumer preferences,” Gocsik concluded.

Strategic integration of technology and sustainability measures will be crucial for overcoming challenges and leveraging opportunities in 2026.