EU milk production continues downward trend - GAIN

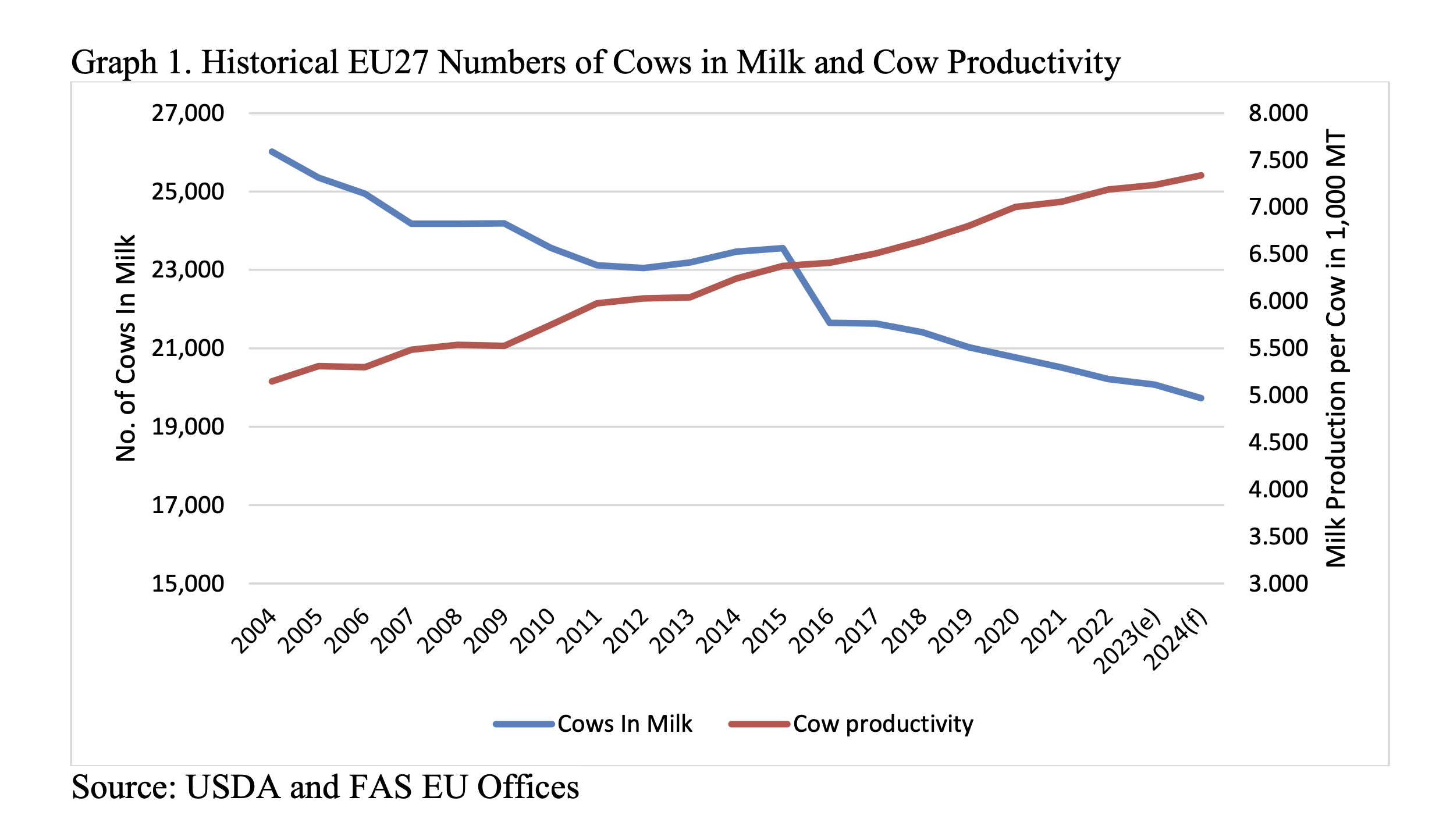

2024 cow milk production forecast to shrink 0.3%At the beginning of 2024, dairy cow numbers in the European Union amounted to 19.7 million cows in milk, continuing a declining trend and dropping below 20 million for the first time, according to a recent US Department of Agriculture (USDA) Global Agricultural Information Network (GAIN) report.

Consistent growth in cow productivity is not expected to fully compensate for declining cow inventories in 2024, and as a result, EU27 cow milk production is forecast to shrink by 0.3%. In January-February 2024, cows’ milk deliveries to dairies increased by 1.7%, as compared to January-February 2023 (without leap year adjustment). However, those increases are expected to fall throughout the year, as a number of farmers that have kept their cows longer or postponed exiting milk production are expected to do so later in 2024.

Milk production profitability has been sliding since the beginning of 2023, with dropping farm-gate milk prices and decreasing, but still elevated, production costs (energy, fertilisers, and labour). As a result, in

Germany, France, Poland, and Belgium, expectations are that the number of dairy farmers will continue to decrease in 2024. However, the losses are expected mainly in smaller and less efficient farms.

Additionally, environmental restrictions, such as the Dutch and Irish government plans to cut nitrogen emissions, are forecast to negatively influence dairy cow herd numbers in the longer term. These factors

– combined with problems of generation renewal (young farmers not willing to continue milk production due to the heavy workload and tight profits) – will likely lead to further market consolidation and farm closures throughout 2024. However, bigger and more professional farms are expected to largely maintain their herd numbers, slowing the pace of the reduction in cow numbers in future years.

The increase in cows’ milk deliveries to dairies in 2022 and 2023 was stimulated by record-high EU average farm gate milk prices throughout 2022, peaking in December 2022. From May 2023 through March 2024, the average EU prices offered to milk producers were below the levels of the same period a year ago, although prices remained above the 5-year average.

One of the main reasons for the decline in farm gate milk prices was the increase in milk production among the world's largest exporters of dairy products and weaker demand for diary commodities among

the world's largest importers. However, as reported by the European Commission (EC), milk production growth in the main exporting countries/regions (Australia, the EU, the United States, the UK, and New

Zealand) observed at the beginning of 2023 has been slowing since July 2023, especially in New Zealand and the United States, resulting in a global 2023 milk collection increase of only 0.1%.

Further contractions are expected by the EU dairy industry in 2024 as producers are facing reduced milk prices and still elevated input costs. Despite the milk price reduction in the EU27, in February 2024 it

remained at the highest among the major competitors, amounting to EUR 46.42 per 100 kilograms, 27% higher than New Zealand’s price and 18 percent higher than the US price. This higher relative milk price is expected to make the European production of dairy products more expensive than the other world exporters.

Green feed availability and pasture conditions in the spring of 2024 were generally good throughout Europe. As assessed by the European Commission's Joint Research Centre, the spring had exceptionally

warm temperatures with frequent but not excessive rainfall, particularly in central Europe, which were beneficial for biomass accumulation. The situation was different in the northwest, where wet soils combined with recent rainfall events continued to hamper access to fields and the regrowth of grassland, which negatively influenced milk production, particularly in Ireland. The Irish dairy industry is based on cattle being out in pasture for up to nine months of the year, with 95% of their diet being grass.

Extremely challenging weather in the early summer curtailed grass growth in 2023, and heavy rains in the fall meant grazing conditions were also difficult. Although feed availability is expected to improve in many EU Members States in 2024, still high costs of energy and fertilisers negatively weigh on farmers’ margins, especially when combined with declining farm-gate milk prices.

In 2023, EU27 cow’s milk deliveries marginally declined by 0.03 percent to 145.24 million metric tons (MMT), despite a 1.4-percent increase noted by the largest producer, Germany, higher production noted

by the Netherlands and Poland, and stable production in Spain. These increases did not fully compensate for a fall in production in the remaining top-seven producers of France, Italy, and notably Ireland, negatively influenced by green feed availability. With unfavourable weather conditions, Irish milk deliveries to dairies in 2023 were 4% down year-on-year.

2024 cow’s milk deliveries are forecast at 144.8 MMT, with a small decrease of 0.3%.