US cattle inventory is down in latest report

Latest analysis from AFBF finds that the USDA's August Cattle on Feed Report shows decreased inventory and placements at the low end of what was forecast.

USDA’s latest Cattle on Feed report, released 20 August, shows the number of animals on feed as of 1 August is 1.9% below year-ago levels. The report provides monthly estimates of the number of cattle being fed for slaughter. For the report, USDA surveys feedlots of 1,000 head or more, as this represents 85% of all fed cattle. Cattle feeders provide data on inventory, placements, marketings and other disappearance. It is important to remember that due to COVID-19 disruptions last year, typical year-over-year comparisons need to be contextualized.

August Cattle on Feed Report

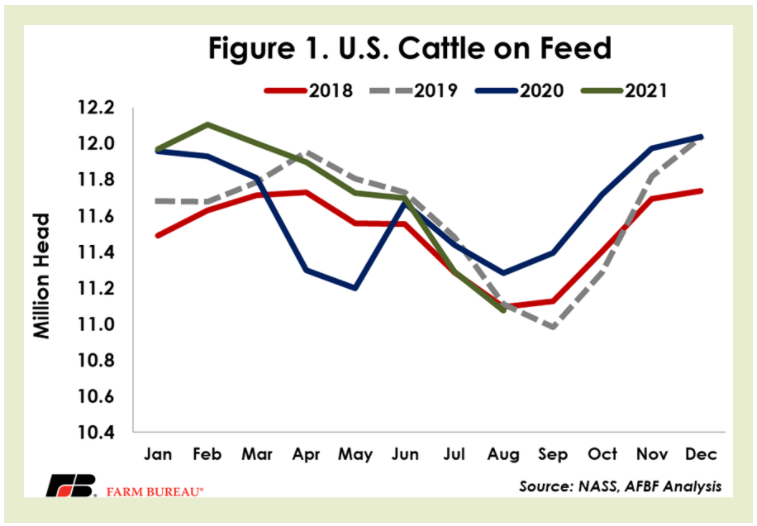

This report showed a total inventory of 11.074 million head in the United States on 1 August, down from the same time in 2020, and down 0.3% from 2019. This 1.9% decrease is in line with analysts’ expectations of feedlot inventories dropping 1.8% from last year. This average expectation fell within a relatively tight range of a 1.2% to 2.3% decline. This decline is part of a normal seasonal decline that typically occurs throughout the summer and into September. It also reflects where we are in the contraction phase of the cattle cycle.

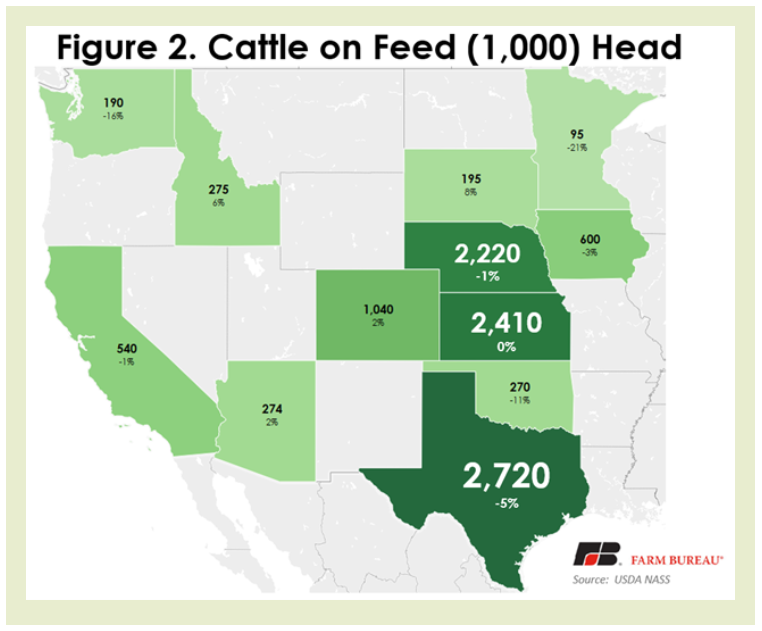

As usual, Texas, Kansas and Nebraska led the way in total fed cattle numbers, accounting for 7.5 million head, or approximately 69% of the total on-feed inventory in the country. Kansas posted numbers even with last year, while Nebraska came in at 1% below 2020 and Texas came in at 5% below last year.

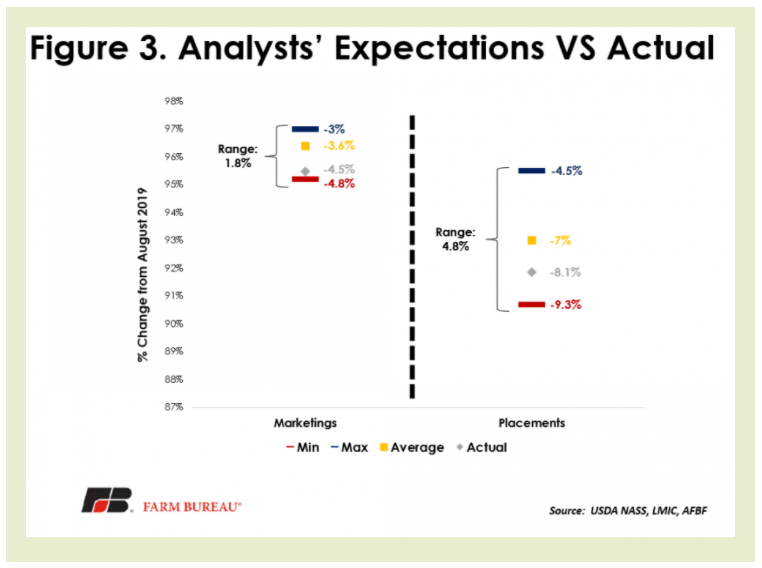

While total inventories are an important component of the report, other key factors include placements (new animals being placed on feed) and marketings (animals being taken off feed and sold for slaughter). Coming in at 8.1% below 2020, placements in July came in below the average analyst expectation of a 7% decrease. The analysts’ forecasts for the placements number ranged from a decline of 9.3% to a decline of 4.5%, and this number fell at the low end of market expectations. A 8.1% decrease may not be as big a decline as it seems if we remember that 2020 saw the highest July placements in a decade. When looking at recent historical data, July placements typically decline from the previous month, but this year marks two years in a row of bucking that trend. Also driving the decline in placements are a drop in feeder cattle imports into the US In July, placements clocked in at 1.739 million head, 154,000 head below a year ago. Marketings came in at 1.900 million head, or 4.5% below last year. This is below the average analyst expectation of a 3.6% decrease over year-ago levels, and at the lower end of the range of forecasts. Analysts’ predictions for marketings ranged from a decrease of 4.8% to 3%.

The declining inventory levels combined with declining placements continue to point towards a tightening of fed cattle numbers. This will likely result in downward pressure on beef production in early 2022, especially when combined with slightly lower dressed weights relative to 2020. The placement numbers may actually be higher than they could be considering the effects of the ongoing drought in much of the US, which is likely leading producers short on forage and feed supplies to place animals sooner than they normally would have been.

Summary

This August Cattle on Feed report is considered relatively neutral to bullish due to lower-than-expected placements with the forecasted placement number coming in at the lower end of the range. The overall supply of cattle on feed is down nearly 2% from last year but only 0.3% below 2019, and the number of animals marketed throughout July is 4.5% below a year ago, and also at the lower part of the range of expectations. Many producers remain focused on the weather as dry conditions continue to limit forage availability.