More Stable Year for EU Dairy; Exports Essential

EU - European dairy markets are expected to become more balanced in 2017, providing more stability than has been seen over the past two years.However, a robust export performance remains crucial. This is the general view to come out of this week’s Eucolait meeting, which provided an overview of milk production and demand expectations for manufactured dairy products.

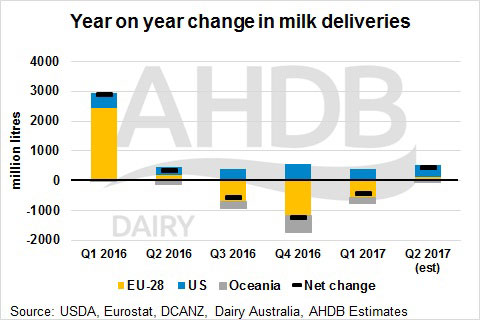

Global milk supplies are expected to remain below previous year levels in most of the key exporting nations in the first half of 2017, with the possibility of some growth in the second half of the year. Higher prices are likely to stimulate increased milk production, but, in the EU, this could be limited by the requirement to reduce cow numbers to meet phosphate regulation targets in the Netherlands.

Supplies coming out of Oceania will be limited for the first half of the year, as they move into the trough period. This will be compounded by continued challenges around grazing, arising from unfavourable weather conditions. EU production remains below previous year levels, although it is rising seasonally and the gap is closing. The US remains in growth, due to improving yields and stable margins.

Demand for cheese and butter is expected to remain robust through 2017, with per capita consumption within the EU rising. The general consensus of those in the room was that current stocks of cheese and butter are relatively tight, which, along with lower milk deliveries, should help to keep markets better balanced than in the past two years.

Cheese production is expected to continue to grow at an EU level, and the weak Euro will help to maintain export sales. While growing per capita consumption in the domestic market will account for some of the growth, access to export markets will be crucial to keeping the market balanced.

Butter production is also expected to grow in the EU, although with stocks believed to be relatively low, most of the additional production is likely to be used to satisfy domestic demand. This will leave less available for export, keeping markets firm. The main risk to pricing in butter markets will come from the high prices leading to substitution by vegetable fats within the food manufacturing sector.

The outlook for SMP markets is more complicated, due to the presence of high stock levels and the expectation of increased butter production, as the SMP is often produced alongside it. SMP production was not expected to increase above 2016 levels through the year but without higher exports, there will be no reduction on stocks.

Globally, there are likely to be lower exports of SMP from NZ, as milk is diverted to WMP and added-value products. Counterbalancing this was the view that the US may increase its SMP exports, as milk production continues to grow. Demand for SMP is still growing on a global level, helping to support the market, but price rises are expected to be limited by high stocks.

Overall, strong export performance is a key determinant of stability in EU markets. As such, the impact of political instability, weak currencies, historically low oil prices and trade policy on demand from importing regions will play an important role in how markets develop.

TheCattleSite News Desk