Rabobank: Economies of Scale Make Big Dairies Bigger in US

ANALYSIS - Economies of scale drive the profitability of large US dairy farms, leading Rabobank to believe dairy consolidating will not only continue but will encourage producers and process alike to consider how this impacts their businesses.

These findings are part of a new report from the Rabobank Food & Agribusiness Research and Advisory group, which explores consolidation in the US dairy sector.

“Over the last few decades we have seen a transition in the industry and the rise of larger farms,” noted report author and Rabobank dairy analyst Tom Bailey.

“These larger operations have created a great deal of positive change for the US dairy industry, including reduced environmental impact through much more efficient production.”

The report, Economies of Scale Driving Consolidation in US Dairy: Farmers and Processors Should Both Pay Attention, goes on to note the increase in larger dairy operations has picked up speed over the last decade as market volatility and industry changes have made dairy farming more challenging.

Data going back to 1970 indicates the US dairy industry has seen a steady increase in the average size of dairy farms as larger operations benefited from economies of scale.

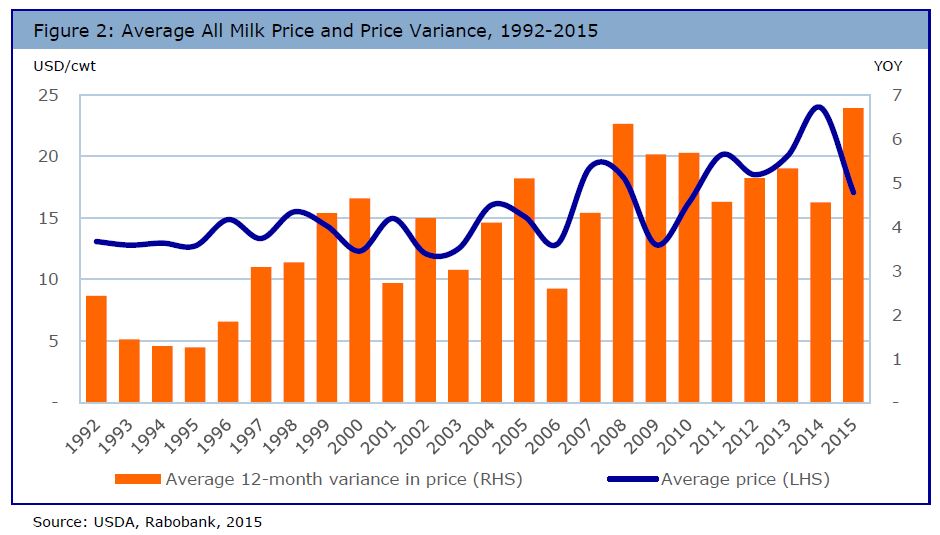

The uptick in consolidation is partly due to increased price volatility. The year-over-year change in average price variation has increased by US$2/cwt over the last decade.

Higher rates can wreak havoc on dairy farms of all sizes with 2009 being an example of low prices taking a toll on both large and small producers.

The full impacts from the current downturn are yet to be seen, but will likely result in more consolidation. It is the larger dairies who tend to have the strategy in place and finances required to withstand market downturns.

“The dairy market is definitely more volatile than it was 30 years ago, but if consolidation and growth are done properly, the operation is ultimately more profitable for large and efficient producers,” note Mr Bailey.

The increasing rate of change has boosted consolidation of US milk production, putting increasing influence in the hands of large farms and sending ripples throughout the US dairy industry.

With large farms likely accounting for the majority of growth in the coming years, US dairy producers and processors alike should be considering the potential impact of this change.

“We find many of the most motivated and successful dairy owners seek growth as part of their future strategy,” noted Mr Bailey.

“We expect both challenges and opportunities for producers and processors alike over the next 10 years.

"As large farms increase their market share, they will continue to put pressure on processors to give them a voice in how their milk is used, they will also face headwinds from increased regulations, consumer pushback, and the implications of being a highly visible part of the industry. For large farms to appropriately address these challenges will take time and money.”