Half Year Market Outlook Is Optimistic

UK - With finished cattle prices reaching an all-time high of comfortably over 300p/kg deadweight this summer and the cull cow trade showing similarly unparalleled strength despite higher levels of supplies, cautious optimism is the tone of the latest EBLEX half year market outlook.

Taking its cue from the 2010 December Agricultural Census, barring significant milk price reversals, the outlook envisages a clear stabilisation in the national dairy herd as the annual decline in breeding cow numbers continues to slow.

However, high feeding and bedding costs are expected to keep a damper on demand for dairy bull calves and with it future dairy beef supplies.

At the same time, the rise in beef breeding cow numbers recorded in the 2010 Census figures is not forecast to have a lasting impact. As well as creating an unexpected rise in 2011 annual beef production, increased slaughterings of both beef cows and heifers in the first half of year suggest the national suckler herd will fall back to around 2009 levels by the end of next year.

This is mainly a consequence of high input costs, a shift in the balance of cow and sheep numbers and farm competition from arable enterprises.

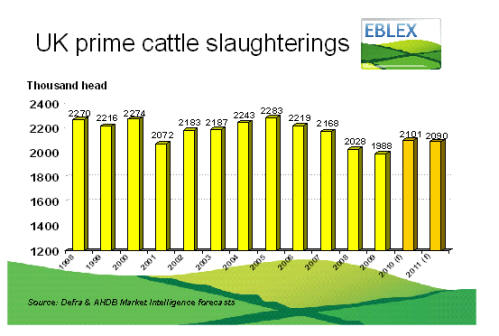

Prime cattle slaughterings are up on 2010 in the year to date. However, the decline in dairy bull registrations recorded by BCMS from last autumn and a projected increase in live calf exports from Northern Ireland is predicted to reduce prime beef supplies across the UK in the second of 2011.

Despite a slight potential increase in beef-bred animals from last year’s larger suckler herd, fewer dairy bulls are also considered likely to restrict slaughterings throughout 2012.

Higher cereal feed costs and limited winter forage supplies are likely to result in lower carcase weights than the past year (when many finishers took stock to higher weights to try to offset relatively high purchased store cattle costs). This combined with reduced 2012 cow slaughterings means that UK beef supplies are forecast to tighten noticeably in the year ahead.

With no additional supplies anticipated from Ireland or South America, imported fresh and frozen beef volumes are expected to be below 2010 levels in both 2011 and 2012.

Equally, continuing firm demand from the continent for manufacturing beef, in particular, is predicted to markedly raise export levels, compensating for any slowing of domestic consumer demand as a result of current austerity measures and inflation levels.

UK Beef Market Figures (tonnes)

| TheCattleSite News Desk | Read more EBLEX News here |