Dairy Australia 2011 Situation & Outlook

Analysis undertaken by Dairy Australia, as part of the 2011 Situation and Outlook Update report, has revealed that instability within the world’s major developed economies is raising questions about the possible likelihood of another financial crisis and the impact it could have on dairy.The industry in 2011 – a platform for growth?

Operating conditions for most in the Australian dairy industry have improved dramatically in 2010/11. However, differences in price signals and demand outlooks highlight significant regional differences.

In 2011, the industry’s position has continued to improve. Global economic recovery and strong regional growth has underpinned steady demand expansion in key markets, while lower-than expected international supplies saw dairy commodity prices rise sharply in US dollar terms through 2010 and into early 2011.

While the benefit of higher commodity prices for Australian exporters has been constrained by the strong Australian dollar, farmgate prices for southern producers have improved strongly in the 2010/11 season.

Improved milk prices, combined with low grain prices and generally favourable seasonal conditions have provided southern farmers with the best production conditions for more than a decade. In some regions, the excessively wet conditions have actually curtailed feed production and herd productivity.

While cashflows have generally improved, this has merely enabled many producers to restore their financial positions following the shocks of the previous two seasons, while the finance sector is also now generally operating with much tighter controls on debt exposures.

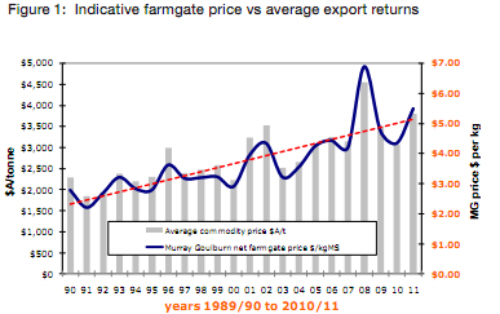

Milk prices in southern regions will finish the 2010/11 season close to an average of $5.50 per kg milk solids. Based on current indications, it is expected that milk prices in these regions over the full 2011/12 season will be close to these levels.

Opening prices announced by manufacturers should be stronger than the previous season’s openings, when there was less certainty about the strength in recovery of world prices.

The 2011/12 opening farmgate milk price announcements will again be important signals for farmers assessing short-term actions regarding their dairy herd size and composition and their longer term confidence in the industry.

The outlook for indicative southern farmgate milk prices, based on current commodity price and exchange rate expectations is for an opening price range of $4.60 to $4.90 per kg MS up from $4.30 to $4.60 per kg MS in 2010. This implies a full year average price range between $5.10 and $5.50 per kg MS – similar to the current season.

International dairy market fundamentals support this price outlook – however, the wider global economic situation remains a threat to the stable market. Currency movements – in particular the strength of the Australian dollar – pose the major threat to the full year price expectations being realised.

The low growth outlook resulting from the uncertainty facing many producers and a slow build in milking cow numbers will sustain the intense competition for southern milk supplies, due to increasing export demand, the need to fill factories and improve efficiencies as well as support future expansion plans.

In northern states, the lingering effects of record rainfall and widespread destructive flooding in most regions of Queensland and Northern NSW will affect the recovery in herd production and feed supplies for a proportion of producers. At the same time WA farmers are dealing with drought and some uncertainty in the processing sector.

While farmgate prices remain stable for many producers, the changes in supply of sizeable supermarket private label milk products is increasingly disruptive for processors and suppliers alike. Increased exposure for many producers to lower milk prices for a portion of their milk supply – reflecting supplies of milk in southern Queensland and NSW that are in excess of processor requirements.

This adds to margin pressures being experienced due to the lack of wholesale price improvements in the retail market. As a result, processors are building in sharper signals which will limit further growth in new supply contracts.

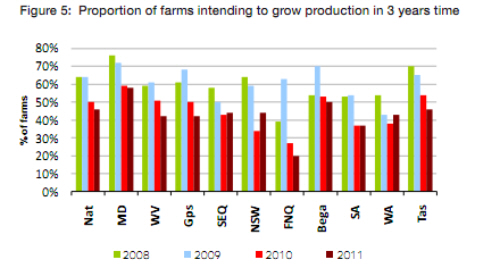

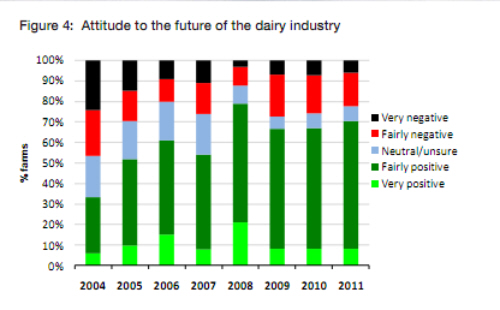

While the external operating conditions for most farmers are positive, overall confidence levels are generally unchanged. There are distinct regional differences, with Victorian regions more positive about the industry’s future and northern and Western Australian farmers increasingly pessimistic. The recent volatility associated with the industry sustains caution in the outlook for many farmers who are seeking a platform of reliable returns before investing further in herd and infrastructure expansion for a longer term future.

Current conditions offer significant opportunities, and there are many examples of producers that continue to adapt and galvanise their production systems and grow their businesses to take advantage of the environment given the strong global demand for dairy products.

Australian market

The Australian economy continues to outperform most in the developed world with GDP growth estimated at 4.25 per cent for 2011/12. However, this healthy growth rate reflects a two-speed economy – with the mining and resources sector continuing to drive the currency higher and the unemployment rate lower. For other sectors such as the dairy industry, the competition for skilled labour and the impacts on international competitiveness are the less positive side-effects of this concentrated mining boom.

While unemployment is low and interest rates are on hold, Australian consumers remain cautious, saving in preference to spending and seeking out value. Rising household fixed costs such as servicing the mortgage, utility and insurance costs, and now petrol prices are limiting the amount of discretionary spend. As a result, eating out is losing some ‘share of stomach’ to take-home retailers.

The major supermarkets have supported this trend by ramping up their private label offerings for “every day” purchases at discounted prices. As a staple, milk has been a key product in this strategy, with price cuts announced at the end of January particularly impacting the higher-margin modified milk category. While still too early to assess the impact of the change, it seems there has been a switch toward private label and an increase in supermarket share of milk sales.

While the initial cuts to private label margins have been absorbed by the major retailers, the dairy industry has raised concerns about the long term impact on the profitability of the fresh milk supply chain if the discounting is continued.

The Australian market has represented a safe haven for the dairy industry in recent years, in contrast to the more volatile international market. However, with increasing pressure on margins, manufacturers will be carefully assessing the relative returns and opportunities for growth represented by the domestic and export markets.

World market

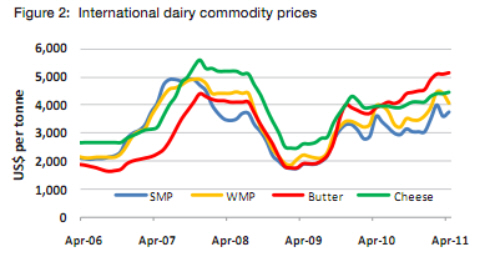

The international dairy market has enjoyed a strong price recovery in 2010/11 with the combination of good demand from the developing markets led by China and Russia, while product supply has been limited due to shortages from southern hemisphere exporters.

The general weakness of the US currency has contributed to higher commodity prices, supporting import demand by making dairy products more affordable in most local currencies.

Product prices peaked in early 2011 at levels below those reached in 2008, retreating due to buyer resistance with the expectation of better product availability from the European production peak and uncertainty surrounding the impact of Middle East unrest and Japan disasters.

The market now appears to be consolidating at relatively high levels, with far less price volatility than has been experienced in the past three years. The uptake of futures products has been slow, but the market has become more accustomed to the price signals generated by globalDairyTrade’s more frequent auction events.

There has been limited substitution of lower priced vegetable oils and proteins, despite the sustained higher dairy products prices. Rising oil prices have contributed to increased volatility in vegetable oil markets, decreasing the attractiveness of these alternatives. It seems premium products that are utilising dairy-based ingredients are less likely to be substituted as consumers have shown a strong preference and willingness to pay for these superior items.

World supply

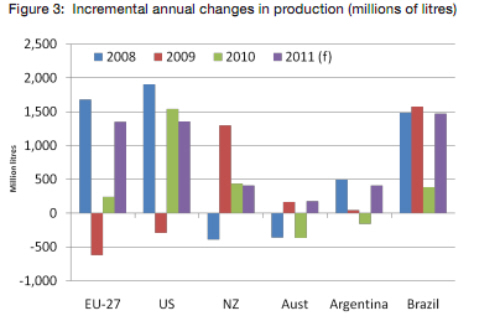

World milk supply has improved in 2010/11 after the effects of price shocks in Europe and the US curtailed output. EU milk output has been well ahead of the prior year, with stronger growth in the past six months, while US monthly total milk flows have been more than two per cent above the prior year since the middle of 2010. Despite improved consumer demand in both regions, export availability has also increased.

New Zealand milk production growth is expected to finish the 2010/11 season not more than three per cent higher than the prior year, again due to drought conditions affecting the North Island. Production is expected to at least return to the longer term average of two to three per cent in 2011/12 as farmers respond to stronger milk payouts.

South American production has rebounded strongly since late 2010, however available export volumes are limited somewhat by stronger demand within the continent. Brazil is now a net importer of dairy products, while Argentina’s strong growth is to a large extent a recovery from the effects of poor weather. Their participation in international trade will be heavily dependent on whether or not the government re-imposes export taxes in an effort to curb domestic food inflation.

The farm sector in 2011

The Australian dairy industry faces very different circumstances regionally and in terms of market exposures. The southern industry is enjoying arguably the most favourable conditions for a decade, with good export demand growth, competition for suppliers and favourable seasonal conditions.

There appears to be a platform for returning to growth with farms re-starting in Northern Victoria, and manufacturers actively encouraging increased output.

In Queensland, and northern New South Wales and Western Australia the industry is geared toward domestic fresh milk supply – a stable market but with limited growth prospects. The uncertainty created by ongoing plant rationalisation and the changeover in increasingly sizeable private label supply contracts for processors is undermining the confidence of farmers in the region and providing limited opportunities for growth into the future.

The polarisation of conditions facing dairy producers around the regions remains a strong feature of the farm sector in 2011, although the differences are virtually all due to the nature and security of milk pricing and supply arrangements.

With the exception of Western Australia, all regions will in 2011/12 benefit from wet conditions and plentiful feed supplies at affordable costs.

Southern regions have enjoyed abundant rainfall that has filled water storages servicing irrigation regions. In some areas this has created production difficulties due to water-logged pastures and herd health problems, limiting growth in output for the current season.

Nevertheless conditions heading into the 2011/12 season are highly favorable, with a good home-grown feedbase, guaranteed access to irrigation water, cows in good condition and continuing export market demand. In general, confidence levels were slightly higher in southern regions compared to this time in 2010, with producer intentions to increase herds by two to three per cent over peak herd numbers in 2010/11 and stronger investment intentions.

Sentiment is far less positive in northern states and WA with the perceived threats to the sustainability of farmgate prices in 2011/12.

Nationally, ABARE estimates indicate average farm cash incomes in the current 2010/11 season of $100,000 – up nearly 30 per cent on last year’s $77,300 – and around nine per cent up on the ten-year average of $91,000. The percentage of farms with a negative cash income has fallen slightly from 24 per cent to 22 per cent.

Average farm business profits are projected to lift from a loss of $1,400 last year to a marginal $5,000 profit. Meanwhile, the percentage of farms with a farm business loss has also fallen slightly from 59 per cent to 55 per cent.

Milk production outlook

Milk production in 2010/11 will post a marginal gain of less than one per cent over the prior year to provide close to 9.1 billion litres. Production in northern regions has been constrained by flooding and cyclones in early 2011. In southern regions feed quality and cow numbers have been the major constraints on production growth.

The outlook for 2011/12 is for a gain of one to two per cent based on herd growth intentions, and the likely positive margins for southern producers over feed costs. Southern regions should post strongest growth, while some further contraction can be expected in northern regions in response to differential milk prices available.

Should these intentions be realised, Australian milk production for 2011/12 would reach 9.25 billion litres. However, there may be some further upside in this forecast, should seasonal conditions continue to be favourable in most regions.

Looking further ahead however, three year production intentions from the 2011 survey showed a further decline in the medium-term growth expectations compared with the 2010 survey. Based on these expectations and assuming reasonable seasonal conditions and prices, milk production could range between 9.2 and 9.5 billion litres by 2013/14.

While sustained milk prices and favourable climate for the majority of producers provides potential for stronger growth into the medium term, there are challenges to expansion.

The policy settings around continued access to water, the impact of any carbon pricing schemes on competitiveness and the ability of the industry to attract, develop and retain people will be important drivers of the industry’s future sustainability and development