US Beef and Dairy Outlook

By USDA, Economic Research Service - This article is an extract from the June 2009 issue of Livestock, Dairy and Poultry Outlook Report.

Cattle: Commercial dairy cow slaughter will increase due to the Cooperatives Working Together program and will offset the decline in beef cow slaughter. Rising costs, reflecting demand for feeder calves to stock rain-improved pastures and rising corn prices, will dampen enthusiasm for feedlot placements aimed at post-summer markets. Beef markets continue to face stiff competition from abundant supplies of pork and poultry.

Beef/Cattle Trade: U.S. beef exports continuing to be affected by weak foreign demand are expected to fall 8 per cent in 2009. Increased imports from Australia are the main driver behind an expected 12-per cent increase in beef imports this year.

Dairy:Reduction in herd size will lead to lower milk production both this year and next despite rising output per cow. Dairy product exports could improve slightly next year; however, domestic use is expected to remain flat in 2110 after a 2-per cent improvement in 2009. Prices for milk and dairy products will show some recovery this year, strengthening further in 2110, but still remain below 2007 and 2008 highs.

Cattle

Dairy Cow Slaughter To Increase

Commercial beef cow slaughter will likely continue below year-earlier levels. Cow-calf producers appear reluctant to increase cow inventories by retaining replacement heifers. In addition, spring rains have reduced the total area affected by dry conditions, providing ample pasture-based forages for the lowest January 1 beef cow inventory since 1963. Second-quarter 2009 total commercial cow slaughter could be down slightly from second-quarter 2008.

However, commercial dairy cow slaughter will increase as a result of liquidation of the sector in response to poor returns. In the second quarter of 2009, increased dairy cow slaughter could offset much, but likely not all, of the reduction in commercial beef cow slaughter due to the producer-funded Cooperatives Working Together program. Combined commercial beef and dairy cow slaughter for the last half of 2009 is expected to be greater than in second-half 2008 as a result of continued heavy dairy cow slaughter and a seasonal increase in beef cow slaughter.

Cattle feeders could break even, or even have marginally positive returns this summer, due to relatively low feeder calf and grain prices this past winter. The relatively low costs of gain for cattle marketed in June and July 2009 will likely be fleeting, and by August, feeding margins likely will again turn negative. The improved pasture conditions will provide support for feeder cattle prices over the next month or so, especially for lighter-weight calves for placement on summer pastures. Limited rainfall in Southern Texas has kept that area below last year’s year-to-date precipitation. Pasture demand will be offset by a lack of enthusiasm on the part of cattle feeders to bid for feeder cattle that are unlikely to yield a profit for the feeder by the time they reach finishing weight this fall and winter. Cattle feeders will be especially reluctant to place cattle if corn prices rise in response to delayed planting.

Memorial Day demand for beef at the wholesale and retail levels was disappointing, as was the accompanying brief rally in wholesale cutout values. Prices have since declined due to both seasonal trends and lackluster demand. Byproduct values have improved from a weekly low this past April, primarily from an increase in hide and tallow prices. Normally, about 60-70 per cent of the byproduct value comes from the value of hides, which are used mostly for car upholstery and shoes. Packers benefit directly from higher byproduct values through increased revenues from cattle slaughtered, while cattle feeders benefit indirectly from packers’ capacity to bid slightly more for fed cattle with higher byproduct values.

Beef/Cattle Trade

A Few Beef Export Markets Remain Strong, but Total Beef Exports Expected To Fall in 2009

U.S. beef exports are expected to decline about 8 per cent in 2009 to 1.744 billion pounds. Although affected by weak foreign demand overall and a stronger U.S. dollar compared with last year, some export markets have experienced growth so far this year. Exports to Japan have increased 19 per cent year-to-date through April and continued to be higher than last year through May, according to FAS Export Sales reports. The Japanese yen has strengthened against the U.S. dollar compared with last year, unlike most other trading partners’ currencies, which has kept U.S. beef more affordable in Japan. Exports to Vietnam have also increased by 74 per cent through April.

However, some of the United State’s largest export markets remain well below last year. Mexico and Canada, which accounted for 55 per cent of U.S. exports in 2008, have been down 19 per cent and 15 per cent, respectively. Exports to South Korea have continued to decline from the beginning of the year. Retail sales of American beef in South Korean supermarkets increased when several of the major retailers started stocking their shelves with U.S. beef in late 2008, but have fallen substantially since the beginning of the calendar year. Declining South Korean imports of beef from Australia and New Zealand, the largest foreign suppliers in 2008, suggest a general weakening demand for imported beef in the country.

The U.S. dollar continues to weaken in the second quarter, after sharply strengthening in late 2008 and into the first few months of 2009. While weak foreign demand for U.S. beef remains a major hurdle in many regions of the world, continuing weakness in the U.S. dollar would help U.S. beef exports. In 2010, exports are expected to increase just over 9 per cent, to 1.905 billion pounds, as foreign demand will likely improve as the global economy recovers from the current recession.

Total Beef Imports Increase in 2009 Driven by Australia

The United States is expected to import 2.839 billion pounds of beef in 2009, a 12- per cent increase from last year. This is primarily due to a significant increase in imports from Australia, increasing 55 per cent year-to-date through April. Markets for beef in South Korea, Russia, and Japan have declined so far this year, but Australian producers have been able to increase their total exports by sending more beef to the United States. Russia has begun to make a modest recovery in beef imports in recent months; however U.S. Customs data shows that Australian beef continues to come to the United States at well above last year’s pace.

Imports from Canada were slightly higher than last year through April. However, U.S. Customs reports show that imports have slowed in recent weeks compared with last year. Feed prices in Canada have increased, and the Canadian dollar has strengthened as oil prices have risen. This could affect both the profitability for cattle feeders and competitiveness of Canadian packers on the export market.

According to AMS reports, the strong Canadian dollar appears to be putting downward pressure on fed cattle prices. With increasing barley prices and declining fed cattle prices, cattle feeders are caught in the middle.

According to CanFax, Canadian feedlots in Alberta and Saskatchewan maintained their inventories just above 2008 levels, but saw lower placements and marketings in April and May. If these economic conditions continue, there could be more Canadian cattle sent to feedlots and packing plants in the United States, reducing Canadian beef supplies available for domestic consumption or to be exported to the United States.

Imports from New Zealand are also expected to continue to be higher than last year, up 3-per cent through April. Cattle slaughter in New Zealand has increased through April, driven by increased cow slaughter. The drop in international dairy prices has forced dairy producers to cull more cows than is usual to reduce milk production. This means that there are more animals being sent to the beef production complex than in a typical year.

In 2010, the United States is expected to import 2.975 billion pounds of beef, a 5- per cent increase. Commercial non-fed beef production is expected to decrease in the United States, allowing foreign beef producers to supply more beef to the United States.

Dairy

Lower Milk Production Provides Basis for Slowly Rising Prices

High feed prices are taking a toll on milk production. Estimated U.S production for April was 0.1 per cent below that of 2008. Production is being reined in as the dairy herd size is contracting. The estimated U.S herd was 9.28 million head in April, down from 9.31 million in April 2008. In 2010, dairy herd contraction is expected to continue and the herd is forecast to average 8.94 million head for the year.

Onthe other hand, production per cow continues to rise, albeit slowly. Production per cow on a daily basis has ranged above year-earlier levels in the first 4 months of 2009. For the year, output per cow is expected to reach 20,445 pounds, up a quarter per cent year-over-year. For 2010, output per cow is forecast to climb to 20,850 pounds per cow, which would represent a 2-per cent increase above 2009’s weak growth.

Feed prices this year are projected to be below 2008’s lofty highs, but still above those in 2007. Corn prices are expected to average over $4.00 per bushel for both the 2008/09 and 2009/10 crop years. Soybean meal prices are expected to decline to average $320 per ton in 2008/09. Meal prices should be slightly lower in 2009/10. Projected relatively high feed prices, especially for corn, will keep the annual average milk-feed price ratio below 2.0 both this year and next. This limits any incentive for herd expansion even with alfalfa hay prices reflecting improved harvest conditions. The Cooperatives Working Together program is expected to remove over 100,000 cows from the herd by mid-summer. In addition, culling will likely be above average as a result of weak returns to producers. The cow removals will boost average output per cow among the remaining herd, but higher feed prices will likely dampen growth in output per cow. The smaller herd size will lead to lower milk production in 2009 and 2010. Milk production is forecast at 187.5 billion pounds this year and 186.4 billion pounds in 2010.

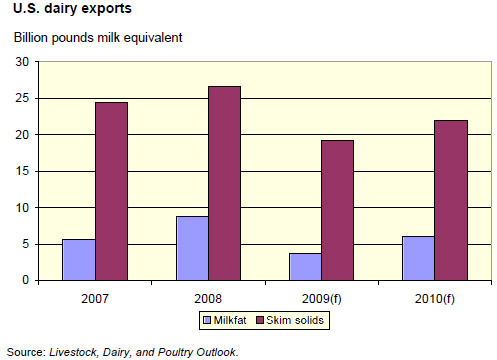

Compounding weakness in domestic demand is the loss of export markets, which expanded rapidly in 2007 and 2008. Commercial exports this year are expected to total only 3.7 billion pounds of milk equivalent on a fat basis (19.7 billion pounds on a skims/solids basis). Fat basis exports are forecast to increase to 3.8 billion pounds of milk equivalent in 2010. Buoyed by stronger nonfat dry milk (NDM) and whey sales, skim/solids exports will increase to 23.1 billion pounds next year.

Domestic commercial use on a fats basis is forecast to rise in 2009 to 186.1 billion pounds, up 1 per cent from 2008, but to remain virtually unchanged in 2010. The reduction in milk supplies is the basis for modestly higher milk and dairy product prices in both 2009 and 2010. Net removals are estimated to reach 234 million pounds in 2009 but are forecast to drop to 10 million pounds next year.

Dairy product prices are forecast to rise. Cheese prices have been close to support levels in recent weeks, but are expected to average $1.235 to $1.275 per pound in 2009. Cheese prices are expected to strengthen throughout 2010. The average 2010 price is forecast at $1.580 to $1.680. For butter, the 2009 prices are expected to average $1.185 to $1.255 per pound for the year. In 2010, prices could rise to average $1.44 to $1.57 per pound. NDM exports have lagged earlier expectations and prices to reflect that fact.

NDM prices are expected to average 83.5 to 87.5 cents per pound this year and $1.000 to $1.070 per pound next year, mostly on the basis of improving exports and tighter supplies. Whey prices show some recovery as exports have improved lately and will average 22.0 to 24.0 cents a pound in 2009 and likely rise to 26.0 to 29.0 cents a pound in 2010.

These product prices will translate into slowly recovering milk prices this year and further recovery in 2010. However prices will remain below 2007 and 2008 highs. The Class IV price is projected to average $10.10 to $10.60 per cwt this year and $12.55 to $13.65 per cwt next year. The Class III price is forecast to average $10.60 to $11.00 per cwt this year and to rise to $14.30 to $15.30 per cwt next year. The all milk price is projected at $11.95 to $12.35 per cwt in 2009 and to climb to $15.10 to $16.10 per cwt in 2010.

Special Section: Dairy Trade

Dairy Product Exports: 2008 Highs and 2009 Lows

The value of U.S. exports of dairy products reached record highs during 2008 as a result of multiple factors, primarily strong global demand for dairy products, reduced global supplies of dairy products, a weak U.S. dollar, and high dairy product prices. As quickly as exports rose, they have fallen towards the end of 2008 and into 2009. As the global economy entered a recession, demand for dairy products dropped off.

At the same time, the U.S. dollar gained in value and production recovered somewhat in dominant dairy product exporting countries such as New Zealand and Australia. Facing a weak domestic market in 2009, U.S. producers continue to look to the export market for potential sales, and the USDA has reactivated the Dairy Export Incentive Program (DEIP) to help move products into international markets.

Market Share Has Been Increasing in Recent Years

Traditionally, the U.S. has been a relatively small player in international dairy markets, but that has been changing in recent years. From 2000 to 2007, the quantity of butter and butter oil exported increased by 925 per cent, cheese by 111 per cent, and nonfat dry milk (NDM) by 80 per cent. While U.S. exports have been increasing, the total quantity of most products exported remains a small per centage of the international market as a whole — in 2007, the U.S. accounted for about 5 per cent of major traders’ butter exports and 8 per cent of cheese exports. The U.S. share of NDM exports was greater, about 23 per cent of exports from major traders.

Increased Demand for Dairy Products in 2008

In 2008, however, it was a different story for U.S. dairy product exports. Both international and domestic market conditions leading up to 2008 helped create an environment in which the U.S. could capture a greater share of the international market for a limited time. Starting in about 2001, international demand for dairy products increased steadily as world income increased. Increased income, coupled with a greater demand for a Westernized diet in many developing countries, led to increased imports of dairy products. Population growth, urbanization, growth of fast food outlets, demographic shifts, and a change in relative prices of other goods were also factors that led to increased dairy product consumption and imports by developing countries. For many of these countries, production-limiting factors such as tropical climates, land and feed scarcity, and high transaction and transportation costs constrained domestic dairy industry capacity to meet the rising demands for milk and dairy products.

Increased demand came not only from developing countries, but also from oilexporting countries flush with oil revenues from record-high petroleum prices. Countries such as Saudi Arabia, Iran, Algeria, and Russia imported large quantities of dairy products. Additionally, developed countries continued to demand valueadded dairy products in the early 2000s, not only for retail sales, but also for their large food service industries.

Decreased Supply in 2008 from Oceania and the EU

Increasing demands coincided with a decreased supply due to drought conditions in New Zealand and Australia, two of the three largest exporters of dairy products. Drought conditions in New Zealand and Australia reduced milk production by about 3 per cent for each country from 2007 to 2008. With a decreased milk supply, exports of dairy products dropped as well.

The EU also saw a decline in dairy product exports in 2007 and 2008. Milk production dropped sharply in 2006 and had not fully recovered by 2008. With a large domestic market to serve, butter, cheese, and NDM exports from the EU fell.

The United States, by comparison, saw an increase in production from 2007 to 2008. Production of nonfat dry milk and skim milk powders rose by over 26 per cent and whole milk powder by over 58 per cent, with the majority of these products destined for international markets. The U.S. dairy herd expanded by 112,000 cows during 2008, and milk production per cow per day grew although it lagged historical trends. This production expansion left the U.S. well-positioned to meet increased global demand for dairy products in 2008.

The final factor that tipped the export market in favor of the United States was the exchange rate. The value of the U.S. dollar was weak in 2007 and 2008, making U.S. exports a more attractive buy for other countries, compared with products from competitors such as New Zealand, Australia, and the EU.

Weak Global Economy Will Weigh on Trade in 2009

The decline in international demand for dairy products started in late 2008 as a result of the global recession. Incomes around the world have fallen and consumers in many countries are expected to limit demands for cheese, butter, WMP, and NDM in 2009.

Global dairy production is expected to rise in 2009. Improved weather conditions have allowed production to rebound in a number of traditional exporting countries such as the EU-27, Australia, and New Zealand. In the face of weaker global demand, it is expected that higher levels of exportable supplies in these countries will allow them to regain market share lost to the United States in 2007 and 2008. DEIP Resurfaces

As the United States loses international market share and the domestic market remains weak, with milk prices below production costs, many U.S. producers have been asking for Government assistance. After a long period of inactivity, on May 22, 2009 the USDA announced allocations for DEIP to help U.S. dairy farmers remain active participants in the international markets. A principle objective of the program is to help U.S. exports in markets where U.S. products are not competitive due to the subsidized dairy products from other countries. Under DEIP, the USDA accepts bids from exporters and awards payments based on the competiveness of the bid, which represents the difference between the cost of purchasing the domestic product and the selling price in the importing country. DEIP allocates specified quantities of dairy products that are eligible for export assistance, as per WTO commitments.

In January 2009, the EU re-opened its program to subsidize dairy product exports and aid its own domestic dairy industry. It remains to be seen how EU and U.S. subsidy programs will impact international dairy product prices. While the EU and the United States are both large players in the global dairy market, Oceania still dominates the market in most dairy product categories and has lower production costs and no domestic support programs. Both the EU and the United States have publically stated that their export subsidy programs will not impact world market prices. Under WTO limits, the EU can subsidize about 2 million MT or roughly $3.1 billion dollars of dairy products. EU eligible allocations for NDM and butter, however, are above projected export quantities of those products for 2009. The United States can subsidize just over 92,000 MT, or roughly $116.6 million dollars, of dairy products.

The long-term forecasts for the U.S. dairy sector (determined prior to the DEIP allocation announcement) are for herd size and exports to continue to decrease and milk production per cow and domestic consumption to continue to increase.

Further Reading

| - | You can view the full report by clicking here. |

June 2009