Canada Dairy Products Annual 2008

Canadian milk production is forecast to remain in the range of 8.21-8.25 million metric tons in 2008 and 2009, reports USDA, Foreign Agricultural Service. A link to the full report is provided below.Report Highlights

The slight increase reflects need to rebuild stocks. Cheese production is forecast to decline slightly to 306,000 metric tons in 2008 and decline further in 2009 to 305,000 metric tons due to reduced consumer demand for specialty cheese during tight financial times. Milk consumption remains flat, averaging around 83 liters per person with increasing demand for lower fat milk and products. Increasing use of the Import for Re- Export Program has resulted in some increase in imports but these commodities are required to be exported after processing. Canada’s new cheese compositional standards take effect on December 14, 2008 and are generally aimed at increasing the use of Canadian fluid milk. As Canadian cheese producers adapt to the new requirements use of other dairy ingredients will shift and trade will be affected but the magnitude cannot yet be evaluated.

Production

Milk production in Canada supplies two markets. The fluid milk market includes creams and flavored milks. The industrial milk market is milk used for to make products such as butter, cheese, yogurt, ice cream and milk powders. In Canada, provincial milk marketing boards maintain responsibility for setting production limits of its own fluid milk, pricing formulas, quota policies and other regulations. Industrial milk production levels are allocated using a national management tool called the Market Sharing Quota (MSQ). Quota is allocated on a butterfat basis. It is set by the Canadian Milk Supply Management Committee (CMSMC), which applies the terms of the National Milk Marketing Plan (a federal-provincial agreement) to establish each province’s share of the MSQ. The provinces are then responsible for distributing shares of the quota to producers according to provincial policies and in accordance with pooling agreements.

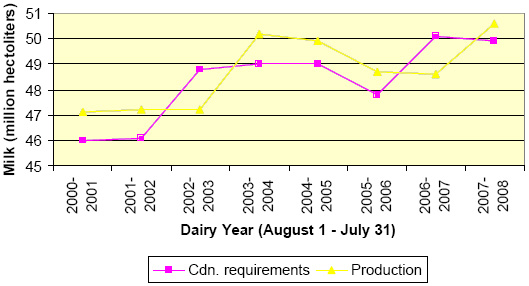

The CMSMC sets the MSQ based on the recommendations of the Canadian Dairy Commission (CDC). The CDC monitors the trends in Canadian dairy requirements (demand) and makes recommendations on the necessary adjustments to reflect changes in demand for milk for industrial dairy products. Figure 1 illustrates the increase in Canadian dairy requirements and milk production for industrial purposes over time by dairy year. While Canadian dairy requirements for dairy year 2007-2008 (August 1 – July 31) have stayed at relatively the same level as the previous year, milk production has increased 4% compared to the previous year. This is due to the fact that in 2006-2007 the dairy requirements were being met through a release of stocks rather than an increase in production. In dairy year 2007-2008, an increase in production from the previous year’s level was needed to meet the Canadian dairy requirements.

Figure 1: Canadian Dairy Requirements and Production for Industrial Milk Market

Based on 6 months of production data of milk produced for the fluid milk market and for the industrial milk market, total milk production for calendar year 2008 is forecast to increase to 8.27 million metric tons (MMT) from 8.21 MMT in 2007. The increase in production from the previous year is in response to the need to rebuild stocks to prevent a shortage in the fall. For 2009, milk production is forecast to remain at relatively the same level, or perhaps decrease slightly if support prices are increased further to reflect increases in dairy producer’s costs of production. Milk production for 2009 is forecast at 8.25 MMT.

Total cheese production for 2008 is expected to decrease to 306 thousand metric tons (TMT), a 1% decrease from year 2007 levels of 308 TMT. Cheese production has been adjusted to exclude fresh cheeses such as ricotta, cream cheese, and cottage cheese. Production of specialty (variety) cheese (excluding ricotta, cream cheese, and cottage cheese) is forecast to remain at 168 TMT, the same level as in 2007. Cheddar cheese production is forecast to decrease to approximately 107 TMT in 2008, a 1% decrease from year 2007 production levels. In addition to the decrease in cheddar cheese production, a decrease in mozzarella production (including for pizza) is also principally responsible for the decrease in total cheese production in 2008. This may be a reflection of higher prices changing the demand for these products both at the consumer level a nd at the manufacturing level. Total cheese production is forecast to decrease a further by 2% to 305 TMT in 2009 due to an expected decrease in consumer demand. Higher dairy prices and a slowing Canadian economy resulting from the world financial crisis is expected to negatively impact consumer demand. Consumers tend to decrease their consumption of specialty cheeses during such times.

The first 8 months of butter production data from Statistics Canada shows a 7% increase in butter production in year 2008 compared to the same period of time in 2007. This increase is attributed to the need to replenish butter stocks and meet the Canadian demand. Butter production in 2008 is forecasted to reach 84 TMT by the end of the year. In 2009, butter production is forecast to decline slightly as a result of reduced demand created by the slow down of the Canadian economy. Butter is considered by many consumers to be a luxury good. Butter production has declined from a high of 99,426 MT in 1990 to a low of 75,832 MT in 2002 to a new low of 75,406 MT in 2006. Between 2002 and 2008, butter production rebounded due to the increasing demand for butter for pastries and other baked products. Butter production in 2009 is expected to fall to 80 TMT in response to a decrease in consumer demand due to tougher economic times.

Non-fat dry milk production (skim milk powder (SMP)) production for 2008 is expected to increase by 11% to 83 TMT from 79 TMT in 2007 due to an increase in butter production. Lower butter production is expected in 2009 and this is expected to result in a corresponding decline of skim milk powder production in 2009. Skim milk powder production for 2009 is expected to fall to 80 TMT.

Consumption

Per Capita Consumption of Dairy Products

Per-capita milk consumption, calculated by dividing annual fluid milk sales of standard, 2%, 1%, skim and chocolate milk by the Canadian population decreased slightly in 2007 to 82.8 from 83.0 liters per person in 2006. Consumption of higher-fat milk like 3.25% and 2%, continued to decline in 2007 as consumers continue to shift consumption away from higher-fat milk in favor of 1% and skim, and as chocolate milk continues to gain in popularity. In 2007, consumption of standard and 2 % milk decreased 3% and 1%, respectively from 2006 levels. In 2007, skim milk consumption increased by 1% from 2006 levels, as did consumption of 1% milk. Chocolate milk consumption increased again in 2007, increasing 3% from 2006 levels.

In the move away from higher-fat milk, consumers are shifting primarily towards 1% milk and chocolate milk. In 2007, standard milk accounted for 14.5% of milk sales (14.9% in 2006), 2% milk accounted for 46.0% of milk sales (down from 46.2% in 2006), 1% milk accounted for 22.1% of milk sales (up from 21.8% in 2006), skim milk accounted for 10.6% of milk sales (up from 10.5% in 2006), and chocolate milk accounted for 6.9% of total fluid milk sales (up from 6.6% in 2006). Fluid milk sales reflect the changing trend in fluid milk consumption. Canada’s changing demographics and the availability of other calcium-fortified beverages such as soy beverages, has reduced consumer demand for milk over the past ten years. Immigration is responsible for the population growth in Canada and milk drinking often is not part of new Canadians’ cultural eating patterns. This has a negative impact on total milk consumption in Canada. Conflicting health messages regarding the consumption of milk has also led to the increased popularity of new beverage such as s oy beverages that compete with milk. The dairy industry has tried to counter this with the promotion of milk as an alternative to sugary fruit and soft drinks and as a way of combating obesity-related issues. Dairy Farmers of Canada has now focused marketing efforts on highlighting the benefits of drinking a glass of chocolate milk after a hard workout.

In 2008, based on six months of sales data, total milk per capita consumption is expected to remain unchanged from 2007 levels. Sales data shows that a 6% increase in chocolate milk sales will likely be off-set by a decrease in sales of standard milk. Increases in dairy prices and people reducing their consumption of specialty coffees and coffee products due to a slowing Canadian economy are expecting to be contributing factors to no growth.

According to the data compiled by Agriculture Canada’s Dairy Section, per-capita total cheese consumption (including fresh cheese) in 2007 was 12.65 kilograms, a 2% increase from 2006. Growth in cheddar cheese consumption (2%), and specialty cheeses (2%) are principally responsible for this increase.

In 2007, data compiled by Agriculture Canada’s Dairy Section reveals that per-capita butter consumption decreased for the first time in the last 10 years. Much of the decrease can be attributed to the decrease in the number of imports arriving under the Import for Re-Export Program (IREP) for use in further processing in 2007 as these imports are a part of the per-capita consumption calculation. Per capita consumption of butter in 2007 fell to 2.65 kilograms per person from 3.83 kilograms per person in 2006, a 6% decrease. The high cost of butter and greater competition from liquid oils as consumers continue to demand healthier and lower-fat alternatives to traditional products, may also be contributing to the consumer’s demand for butter.

Domestic consumption of skim milk powder decreased in 2007 by 26% from year 2006 levels to 1.78 kilograms per capita. This decrease is largely due to the reduction in skim milk powder trade going on under the IREP program. The Canadian Dairy Commission has been working hard to develop new uses and markets for the surplus powder. The Dairy Marketing Program was expanded in 2004/2005 into the area of innovation; the program’s main objectives are to promote awareness and increase utilization of dairy p roducts and components by food product manufacturers. This includes finding new and innovative uses for skim milk powder in dairy and food products. The milk produced in Canada is sold to processors through a Harmonized Milk Classification System for the manufacture of products. The products are broken into 5 classes. The creation of a new milk class that encourages the use of skim milk powder has also aided in the utilization and reduction of the surplus skim milk powder. The utilization of skim milk powder in animal feed is an additional outlet that is aggressively being pursued. The consumption of skim milk powder is expected to stay high, and will face reduced competition from imports once the impact of the new TRQ on milk protein concentrates is implemented. Of note, this new TRQ will not be applicable to the United States.

Further Reading

| - | You can view the full report by clicking here. |

List of Articles in this series

To view our complete list of Dairy and Products Annual, and Semi-Annual reports, please click hereDecember 2008