Cattle Situation and Outlook

By the Livestock Marketing Information Center, North Dakota State University Extension Services in Cooperation with United States Department of Agriculture. This report provides analysis and comments of the US cattle situation and outlook for 2008.Cattle and beef markets in the first half of 2008 were impacted by a number of factors, which will continue to have a strong influence for the remainder of the year. Consumer demand for red meats have suffered some this year due to sluggish economic conditions as energy, food, and fuel prices continued to rise. Record high corn prices impacted livestock markets and cattle feeding flowed red ink. In 2008, most cow-calf operations will have their worst financial year in a decade. Fed cattle prices in 2008 will be record high and more records are expected. Calf and yearling prices will remain subject to the ups-and-downs of the corn market.

The increasing cost of production brought on by rising feedstuff and energy prices has become a major issue for many U.S. cattle producers. In the first half of 2008, domestic cow slaughter increased causing beef cowherd contraction. Looking ahead, beef market participants should keep an eye on several factors, including: 1) the extent of U.S. beef export sales to foreign markets, especially in Asia; 2) the rate of decline in U.S. beef imports; 3) feed grain and forage prices, particularly the impacts of ethanol demand; and 4) the rate of U.S. beef cow slaughter.

U.S. beef production for 2008 is forecast to be slightly higher than last year (up about 1 percent). However, increased beef exports and decreased imports will cause per capita beef consumption to decline in 2008. U.S. heifer slaughter in 2009 is expected to increase, but overall beef production may actually decline some. Growth in beef exports will translate into another decline in U.S. per capita beef availability and consumption. Further, at least for the first several months of 2009, pork and poultry production also are forecast to post year-to-year declines. For the calendar year of 2008, slaughter steer prices will likely average $3.00 to $4.00 per cwt.

(3 percent) above 2007’s and over $90.00 per cwt. for the first time. Yearling steer prices will likely average slightly below 2007’s. Feedstuff costs will cause a year-to-year decline in steer calf prices, which are expected to decline $3.00 to $6.00 per cwt. compared to 2007’s. Cull cow prices are expected to remain above a year ago. In 2009 and 2010 annual average slaughter steer prices are forecast to continue posting year-to-year increases and are forecast to average over $100.00 per cwt. for the first time in 2010. Calf and yearling prices will depend on feedstuff costs in 2009 and 2010. If annual average corn prices received by farmers remain in the $5.00 to $5.50 range, calf prices in 2010 are likely to post year-to-year increases.

Mid-Year Cattle Inventory Declines

USDA’s mid-year U.S cattle inventory reinforced expectations that the cowherd did not cyclically increase this year due to increased production costs and lower calf prices. As of July 1st, the total number of beef and dairy cows in the U.S. was slightly less than a year ago.

According to USDA, as of July 1st, all cattle and calves in the U.S. totaled 104.3 million head; 500 thousand head below a year ago and one percent lower than 2006’s. The number of beef cows was reported at 33.15 million head, 200 thousand head less than the prior year. That was the smallest beef cowherd number since 1990. The number of heifers 500 pounds and over held for beef replacements totaled 4.6 million head, down 2 percent (100,000 head) from last year. The number of steers 500 pounds and heavier was reported at one percent smaller than a year ago.

The USDA estimated the 2008 U.S. calf crop at slightly less than the prior year and down one percent from 2006’s. At mid-year, the calculated number of feeder cattle supplies outside feedlots was above a year ago (up nearly 300,000 head) as cattle feeders have transitioned to placing a greater number of heavier weight cattle than in recent years in light of high feedstuff costs.

A Look Back: Prices and Rising Costs

In the first quarter, slaughter steer prices averaged just over $90.00 per cwt., slightly below last year. Prices improved to just under $93.00 per cwt. in the second quarter of this year, but were still about two percent lower than a year earlier. For the first half of the year, slaughter cattle prices were at times pressured by a modest increase in U.S. beef production, record large pork production, and a larger domestic poultry supply. Despite a significantly stronger byproduct (hide, tallow, liver, etc.) value this year, lower packer margins, and sluggish consumer demand further contributed to lower fed cattle prices for the first several months of 2008. Prices struggled in March and early April with weekly fed cattle prices trading in the high $85.00 per cwt. to low $90.00 per cwt. range. However, prices then improved dramatically with fed cattle prices passing the $98.00 per cwt. in the last week of June.

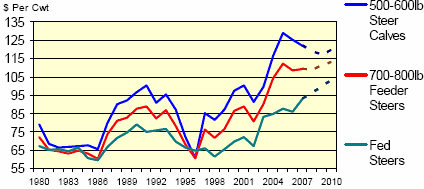

In the first quarter of 2008, calf and yearling prices at major markets were higher than a year ago but remained below 2006’s. Southern Plains feeder steers (700-to 800-pounds) averaged slightly higher than $101.00 per cwt. in the first quarter, while steer calves (500-to 600-pounds) averaged over $122.00 per cwt. During the second quarter, yearling steer prices strengthened relative to the first quarter as feeder demand for heavier weight placements increased in response to high feed grain costs, while calf prices declined slightly. During the first six months of 2008, in the Southern Plains feeder steers (700-to 800 pounds) averaged just over $105.00 per cwt., while steer calf prices averaged nearly $122.00 per cwt.

Omaha cash corn prices in early November 2007 were just over $3.40 per bushel. By early January 1, 2008 corn prices at Omaha were about $4.50 per bushel and then surged to a record of over $7.00 per bushel by the end of July. Hay prices have set several new record highs this year as well. Feedlots that locked-in their fed cattle using forward contracts or the futures markets found that surging feedstuff costs turned profits into red ink, if corn costs also were not locked-in. All cattle producers have also faced record high production costs, including fuel and fertilizer.

Outlook for the Remainder of ‘08

Commercial fed cattle slaughter is expected to be smaller than a year ago in the third and fourth quarters of 2008. Placements of heavier weight feeder cattle into feedlots will delay some fed cattle marketings into early next year that would normally be marketed in the fourth quarter of 2008. U.S. commercial beef production is forecast to be 2 to 3 percent smaller than a year ago in the fourth quarter of 2008.

Besides lower beef production, cattle prices will continue to be supported by strong byproduct values. Slaughter steer prices are projected to be stronger than a year ago for the remainder of this year, with the largest year-to-year increase posted in the fourth quarter. Choice slaughter steer prices in the Southern Plains are projected to average in the upper $90’s per cwt. in the third quarter which would be about 6 percent higher than 2007’s. In the fourth quarter, slaughter steer prices are forecast to average just over $100.00 per cwt., the highest quarterly average ever. For the year, slaughter steer prices should fall within in the $95.00 to $96.00 per cwt. range, over 3 percent higher than 2007’s. In 2008, for the second year in a row, annual slaughter steer prices are expected to average above $90.00 per cwt.

Prices for yearlings will generally remain well above the $100.00 per cwt. level in the Southern Plains during the remainder of 2008. Prices are expected to moderate late this summer and fall due to increased supplies and several quarters of red ink posted by cattle feeders. However, increased demand for heavier weight feeder cattle versus calves should help counter some of the downward pressure. For the second half of the year, Southern Plains yearling steer prices should average mostly in the $108.00 to $115.00 per cwt. range.

In recent weeks, corn prices have moderated significantly. However, corn prices will most likely remain well above a year ago for the balance of the calendar year. So, fed cattle prices above a year ago may not translate calf prices above a year ago. Based on recent corn prices and other factors, for the summer quarter, 500-to 600-pound steers are expected to average in the $117.00 to $120.00 per cwt. range in the Southern Plains. Calf prices are likely to erode slightly the fall quarter. For the year, calf prices are expected to average 3 to 4 percent below 2007’s.

Looking Ahead 2009

Many of the factors that have influenced the beef and cattle markets in 2008 will continue to have an impact on the market in 2009. Any price surprises that may occur, whether positive and negative will most likely happen due to changes in the demand side of the market. For the beef and cattle markets, those demand aspects are rooted in overall U.S. domestic economic conditions, foreign demand for beef and byproducts, and competition from competing meats and poultry in the domestic and international markets.

Looking at the supply side of the market, further cowherd liquidation is expected in the second half of 2008. So beef supplies will remain tight in 2009. Cow-calf operations should keep an eye on feedstuff prices to set calf prices as demand for corn will remain reasonably strong. If there is adequate rainfall, the number of calves grazing wheat and other pastures this fall and winter could be larger than in many years. That could set the stage yearling price volatility, especially in early 2009. If placements of cattle into feedlots bunch-up, that will translate into fed cattle price swings especially next summer.

U.S. heifer slaughter in 2009 will increase due to the financial status of many U.S. cow-calf operations, but steer slaughter is expected to decline reflecting a smaller calf crop. Cattle imports from Mexico and Canada are forecast to decline due to cowherd reductions in those countries. So, U.S. commercial beef production is forecast to post a small annual decrease in 2009. Of importance, the decline in U.S. production will be combined with the potential for increased beef exports and declines in pork and poultry production. Therefore, U.S. consumption of red meat and poultry in 2009 is forecast to decline fully five pounds per person in 2009, the largest yearly decline in over 25 years. This factor will most certainly support cattle prices.

Export markets will remain a crucial factor influencing beef and cattle prices in the upcoming years. In fact, export markets other than for beef will be vital, particularly for pork and chicken. U.S. beef export tonnage may return to pre-2003 levels sometime after 2010, however, further growth in export tonnage is expected during the next few years as remaining trade restrictions are slowly removed. Of course, the value of the U.S. dollar relative to the economic health of many U.S. trading partners will be an important factor in the trade sector as well. In all, overseas markets will probably be rather favorable to U.S. cattle prices.

Looking ahead, the foremost issue weighing on calf and yearling markets will be grain prices. Grain prices are expected remain quite volatile, causing potentially large price swings in calf and yearling prices. Government mandates will ensure continued growth in ethanol production, which will need high enough corn prices to attract additional acreage increases in 2009. Any shortfall in U.S. corn production will have a noticeable and quick negative effect on calf prices.

Cattle prices are forecast to follow a rather normal season pattern in the first half of 2009. Preliminary forecasts put slaughter steers prices about 7 percent higher than 2008’s in the first quarter of 2009, with prices in the second quarter averaging over $100.00 per cwt. (10 percent yearly increase). In the summer quarter of 2009, slaughter steer prices are forecast to be at or below 2008’s due to larger production, but prices could again eclipse 2008’s in the last quarter of 2009. For calendar year 2009, fed cattle prices are forecast to set a new record high and may average in the high $90’s to low $100’s per cwt. For the Southern Plains, forecasts call for calf (500-to 600-pound steer) prices in 2009 to be moderately softer than 2008’s due to relatively high feedstuff costs. Preliminary forecasts suggest calf prices in the first and second quarters of 2009 will be below 2008’s. Calf prices could post year-toyear increases in the second half of next year if feedstuff costs moderate and fed cattle prices are near forecasts. Yearling steer prices are forecast to be slightly higher in 2009 compared to 2008. The lowest 700-to 800-pound steer prices are forecast for the first quarter of 2009 reflecting large supplies of wheat pastured and over wintered animals.

In 2009, cull cows prices are forecast to be record high. Management and marketing of cull cows will be an important profit center of cow-calf operations. Demand for hamburger and other processed meat items will remain strong and supplies may remain tight due to a lack of imported beef from Australia and South America. From a management standpoint, taking an inventory of cows as of July 15, 2008 is important, as premiums received for cows that fit U.S. Country of Origin Labeling retail rules may be beneficial in the long-term.

Higher Prices in 2010

The U.S. cowherd is forecast to decline throughout 2009 meaning, U.S. per capita supplies of red meat and poultry could continue to shrink in 2010. Reflecting a tight domestic supply, per capita beef consumption (retail weight) is forecast to be the smallest since 1959. Cattle numbers in other historical beef and cattle exporting countries are projected to continue to erode as well. U.S. beef export opportunities are expected to increase, but the rate of increase may be tempered by higher domestic beef prices. Looking ahead, U.S. beef production in 2010 is forecast to be the smallest posted since 2005.

Preliminary forecasts for slaughter steers call for new record highs to be established in 2010. Quarterly average slaughter steer prices over $100.00 per cwt. may be the norm and weekly prices over $110.00 may be common. Yearling and calf prices will remain vulnerable to feedstuff cost surges. Based on normal weather and existing government policy regarding ethanol, etc., the annual average cash corn price is forecast to remain well over $5.00 per bushel (national price received by farmers). Even with those corn prices, annual average calf prices in 2010 should up tick for the first time since 2005, returning at least to levels of 2005 and 2006 (mid $120’s in the Southern Plains for 500-to 600-pound steer calves).

Southern Plains

August 2008